From Adanna Nnamani, Abuja

The naira on Tuesday closed trading at N1,604.00 to $1 in the official market, from N1,599.00/ $1 it traded on Monday, data from the Central Bank of Nigeria (CBN) has shown.

The local currency also weakened against other major currencies, trading at N2,115.25 to the British pound, as reported by the apex bank.

In the parallel market, the naira experienced further pressure, exchanging at N1,618/$1, compared to N1,605/$1 the previous day.

Despite this slight setback in exchange rates, stakeholders in the foreign exchange market remain optimistic.

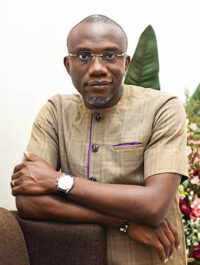

Aminu Gwadabe, the President of the Association of Bureau De Change Operators of Nigeria (ABCON), linked the recent stability in the market and increasing investor confidence to the ongoing reforms and interventions by the Central Bank.

Gwadabe said that the consistent interventions by the Central Bank of Nigeria in the Nigerian Foreign Exchange Market (NFEM) have improved liquidity and mitigated volatility, thereby boosting investor confidence.

Additionally, he pointed out that conducting domestic crude oil transactions in naira has alleviated pressure on the local currency during times of elevated demand.

“The continuation of crude oil sales in naira to local refineries has also doused the escalated demand pressure on the naira during the period of the volatility, which ab initio created tension in the market,” he said.

Gwadabe also pointed out that global developments, such as the revisions and suspensions of U.S. tariffs on major trading partners, have played a dousing role in contributing to recent market gains. “Both global and local markets have responded positively with considerable appreciation,” he added.

He praised the Central Bank of Nigeria (CBN) for its increased transparency and data communication, particularly highlighting the disclosure of a net foreign exchange position exceeding $6 billion. He stated that this transparency is providing the market with greater clarity and boosting investor confidence.

Gwadabe noted an over 9 per cent rise in diaspora remittances, which have now reached $20.98 billion, as further evidence of the effectiveness of the CBN’s shift towards supply-side strategies in the foreign exchange market. “This underscores the resilience of the CBN measures aimed at diversifying our sources of foreign exchange,” he stated.

However, he cautioned that the path to full stability is far from complete, saying, “Despite all these positive indicators, it is still yet uhuru.”

Moreover, he called for continued collaboration between fiscal and monetary authorities, emphasising the need for “humane policies and reforms” under President Bola Tinubu’s administration to combat inflation and address broader economic and security challenges.

Leave a comment