Credo by eTranzact has expanded its footprint in southern Nigeria with a targeted digital payments campaign across three major commercial hubs in Port Harcourt, aiming to help small businesses move from cash to more secure and traceable transaction methods.

The roadshow, organized in partnership with Eligbam City, drew hundreds of participants from the informal retail sector. Many attendees had never used digital point-of-sale or reconciliation tools before. Over several days, the fintech team activated Garrison Computer Village, Rumukalagbor Market, and Rumuomasi Market—introducing local traders and entrepreneurs to its digital payment platform through live demonstrations, hands-on onboarding, and business support sessions.

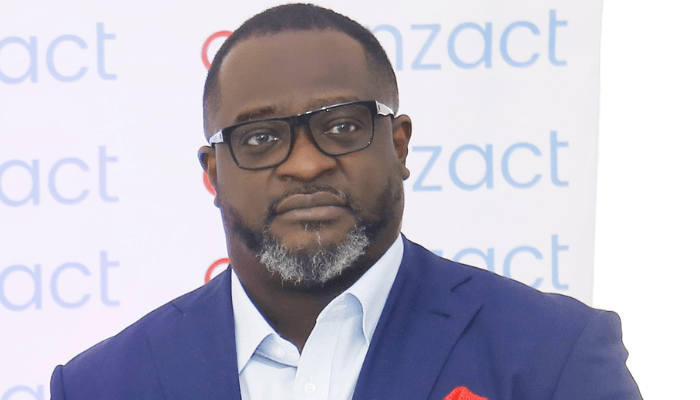

Speaking at the event, Omokorede Amund, Product Marketing Manager, Credo by eTranzact said, “We’re not just building a payment solution, we’re building confidence in the future of small businesses”. The activation focused on addressing real concerns, including transaction security, ease of use, and daily settlement challenges. Traders were shown how to accept payments both online and offline, track sales, and manage records using the Credo platform.

The campaign approach highlights a growing trend among fintechs: moving beyond digital ads and influencer campaigns to engage directly with business owners in markets and other informal spaces.

“Port Harcourt is full of hustle and innovation; this roadshow allowed us to meet business owners where they are and demonstrate practical ways they can benefit from digital payments.”

Amund added the activation also featured a raffle draw, offering prizes such as WiFi routers, cash rewards, and small business tools—an incentive designed to attract participation and provide immediate value to attendees. For many traders in Port Harcourt, the event marked their first real interaction with a payment solution tailored to small businesses, suggesting a shift in how financial services are being introduced to the grassroots economy.

Leave a comment