By Chinwendu Obienyi

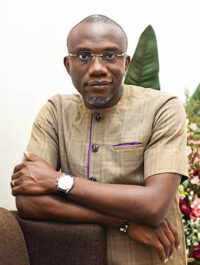

Governor, Central Bank of Nigeria (CBN), Olayemi Cardoso, has called on commercial banks to take full ownership of diaspora-focused financial products and services.

He also urged them to play a more proactive role in reducing the high cost of remittances into the country, describing the average 7 percent remittance fee to Nigeria as “unacceptable,”.

The apex bank Chief said lowering these costs is critical to unlocking the full economic potential of diaspora inflows and enhancing financial inclusion. He gave the charge while responding to questions from journalists on Tuesday in Abuja during the post-Monetary Policy Committee (MPC) media briefing.

Cardoso cited the figure as a major barrier to trust in Nigeria’s financial system and a limiting factor in mobilising diaspora funds for national development.

“This is something I felt so strongly about that I had to raise it directly with the President of the World Bank during the last Spring Meetings. We are now actively exploring collaborative solutions to bring these costs down,” he stated.

According to the CBN Governor, one of the key strategies involves scaling transaction volumes through digital innovations and regulatory partnerships, which would naturally help reduce the average cost of remittances.

He referenced recent breakthroughs in collaboration with the Nigerian Regulatory Bank Verification Network (NRBVN), which has made it easier for Nigerians abroad to remit and invest seamlessly back home.

“This is what our diaspora community has been waiting for, the ability to transact from abroad without friction,” he said. While acknowledging recent progress, Cardoso emphasized that bridging the trust gap requires more than lowering transaction costs. He noted that enhancing Know Your Customer (KYC) frameworks and removing Nigeria from the Financial Action Task Force (FATF) grey list are critical steps to restoring global confidence in Nigeria’s financial system.

“Work is already underway with the Nigeria Inter-Bank Settlement System (NIBSS) to build a more secure and reliable identity verification process,” he added.

Beyond trust, Cardoso addressed longstanding product gaps in the Nigerian banking sector that have left many diaspora Nigerians underserved.

Crediting a recent engagement campaign spanning dialogues with international money transfer operators (IMTOs) and diaspora leaders for helping the CBN and commercial banks better understand the frustrations of Nigerians abroad, he revealed that many banks have long wanted to develop diaspora-friendly products but faced bureaucratic and technical hurdles.

He said, “We have now cleared those roadblocks and urged banks to take full ownership of product development for this market.”

He referenced the CBN’s well-received diaspora banking engagement event held during the annual meetings in Houston, Texas, as a turning point. Since then, several Nigerian banks have begun rolling out bespoke financial products aimed at the diaspora community.

He noted that the CBN is setting its sights on a bold target: $1 billion per month in diaspora inflows. While ambitious, the CBN Governor said the goal is achievable, citing recent monthly inflows that surged from $200 million to over $600 million.

“This is the Nigerian spirit in action. Other countries like India and Pakistan have done it and so why can’t we?” he said.

Cardoso emphasised that the CBN sees its new role not as a sole driver, but as a facilitator and catalyst, clearing the path for private banks and innovators to lead the charge.

“We have opened the door, removed the roadblocks, and handed it over to the banks. They will benefit, and most importantly, all Nigerians will be better off as a result”, he said.

Leave a comment