By Adewale Sanyaolu

As President Bola Tinubu’s administration celebrates two years on May 29, energy experts have asked the presidency to keep the noise level down because the sector, a major fulcrum on which Nigeria’s economy revolves, is still struggling to sail out of local and global storms.

While many argue that industry is going through a transition phase, others hold a different view, insisting that the sector’s growth (if any) is still hobbled by the multifaceted challenges of yesteryears.

They include; insecurity, low output, opaque operational template, insufficient investments and others.

Nonetheless, key conversations on the table today are gas monetisation, refining and petrochemical developments, power sector reforms and the expansion of renewable energy.

Historically, the oil and gas sector contributes a significant but declining portion to Nigeria’s GDP.

While accounting for around 9 per cent of Nigeria’s GDP, recent figures show a contribution in the range of 5-6 per cent. The oil sector also plays a crucial role in Nigeria’s export revenue, accounting for a large percentage of the country’s total exports.

But, the inability of the country to grow oil production beyond current levels of 1.8 million barrels per day(bpd) occasioned by lack of investment and the lack of political will to tame oil theft has retarded government’s revenue generation momentum.

Curiously, the transformation and growth trajectory appears not to have translated to the expected gains for the industry and Nigerians.

The promise by President Bola Tinubu to re-channel the gains of fuel subsidy funds into better investment in public infrastructure, education, health care and jobs that will materially improve the lives of millions has become a mirage as unemployment figures continue to rise while more and more Nigeria are daily being pushed below the poverty ladder.

The lack of adequate infrastructure, particularly in roads, public hospitals, and educational institutions, has deepened the skepticism and concerns among Nigerians.

According to the World Bank, 85 million Nigerians lack access to electricity, a situation that stifles economic growth, hampers digital learning and limits business innovation.

In the power sector, the federal government is still bogged down by the continuous payment of electricity subsidy, which has ballooned to about N800 billion.

However, in the midst of this quagmire, the federal government has recorded some modest achievements aimed at growing the fortunes of the oil and gas sector.

Some of the modest achievements include; petroleum supply stability, completion of divestment by some IOCs, planned take-off of Africa Energy Bank, establishment of five mini LNG projects, award of 10 gas distribution licenses and the signing of the GSPA for the $3.3bn Brass methanol project

Doubts over 2.5m bpd target

The federal government through the Minister of State for Petroleum Resources (Oil), Mr. Heineken Lokbobiri, recently assured that the country would meet the 2.5 million barrels per day oil production target by December.

The Minister said that while President Bola Tinubu gave the new NNPC management a mandate to grow oil production to two million barrels by this year, he has increased the target to 2.5 million bpd

“When the new NNPC management visited me, I increased their oil production target to 2.5 million bpd from the initial two million barrels given to them by the President,” he stated.

Lokpobiri said he believed the target set by the President could be met and surpassed because, during the COVID-19 pandemic, when there were no new investments, oil production grew to 2.5 million bpd.

“The 2.5 million bpd oil production is easily realisable because all the bottlenecks against our oil production are being addressed.

For over 10 years, he said there was no new investment in the oil and gas sector, saying the story has changed today as a result of the reforms of President Bola Tinubu.

But some stakeholders have expressed doubts over the capacity of the country to meet the target by year end.

They argued that the structure, facilities and investments required to meet the ambitious target were simply missing.

They urged the government to shift from mere rhetoric and issuing directives to implementing concrete and effective actions.

Electricity subsidy hits N800bn

The President Bola Tinubu administration continues to struggle to get its feet right in the power sector.

While the Minister of Power, Mr. Adebayo Adelabu, earlier assured that the categorisation of electricity consumers into different bands would resolve the issue of tariff shortfalls, recent feelers have proved otherwise, as those on Band A, who were meant to enjoy an average of 20 hours of power supply daily, have called the promise a hoax and lamented that they have been made to pay more for darkness.

Some of those on Band A have recently staged protests, calling on Discos to downgrade them to lower feeders.

Just last week, the Senate Committee on Power raised concerns over the liquidity crisis bedevilling the power sector, lamenting that the tariff shortfalls in the industry have indicated that the government owes about N200bn to electricity-generating companies every month.

The committee disclosed that since the beginning of the year, the government has not paid the power producers and that the issue has ballooned the debt to about N800 billion.

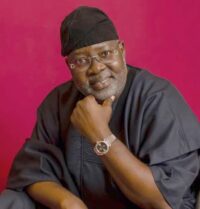

The Chairman of the Committee, Senator Enyinnaya Abaribe, disclosed this while fielding questions from journalists during a retreat held in Ikot Ekpene, Akwa Ibom State, recently.

The retreat, organised by the Nigerian Electricity Regulatory Commission, was to proffer solutions to critical and emerging issues in the Nigerian power sector.

Abaribe expressed worries that the government has yet to make any payment to the power firms this year, indicating that the country is already indebted by N800 billion in addition to previous indebtedness amounting to over N3 trillion.

Grid collapses as power sector albatross

The power sector under the current administration has not recorded significant progress, as businesses and households continue to lament the sector’s negative impact on their overall well-being.

In 2024 alone, the national grid collapsed 12 times, causing widespread disruption. Despite ongoing reforms, Nigeria’s electricity generation stagnates at around 5,000 megawatts—a fraction of what is needed for a country of its size.

By comparison, South Africa and Egypt each generate 58,000 MW, while Algeria produces 24,000 MW. The introduction of new power consumption “bands” has merely increased costs for consumers without delivering a reliable supply.

The consequences are that universities and tertiary hospitals have been disconnected from the grid due to unpaid, exorbitant electricity bills.

The University College Hospital, Nigeria’s leading tertiary health institution, was disconnected from the grid for 100 days. Even Aso Rock, the seat of federal power, cannot afford the huge electricity bills, prompting the government to allocate N10 billion for a solar power project.

Metering of households has equally suffered tremendous setbacks, with the federal government unable to advance to Phase 1 of the National Mass Metering Programme (NMMP), resulting in a growing number of customers being subjected to estimated billing.

FG auctions 25 oil blocks

On December 18, 2024, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) announced successful bidders for 25 oil blocks, which included assets for onshore and deepwater oil fields.

The move was part of efforts aimed at growing Nigeria’s oil production. The final results included the 2022/2023 Deep Offshore Licensing Round and the 2024 Licensing Round.

The results showed six winning bidders and four reserve bidders for the 2022/2023 Deep Offshore Licensing Round, while 19 winning bidders and six reserve bidders were announced for the 2024 Licensing Round.

For the 2022/2023 Deep Offshore Licensing Round, SIFAX and Royalgate won the asset named PPL 300-DO, while the asset codenamed PPL 302-DO was won by Ocean Gate Engineering Oil and Gas Limited, with no firm announced as reserve bidder for the block.

For oil block PPL 303-DO, NUPRC announced MRS Oil and Gas Company Limited as the winning bid, while the reserved bidder is NNPC E&P Ltd.

For PPL 304-DO, SIFAX & Royalgate Consortium was announced as the bid winner, just as Homeland Integrated Offshore Services Limited came up as the reserved bidder.

PPL 305-DO oil block went to Hakilat Oil and Gas Consortium Limited as the winning bid, while NNPC E&P Ltd was announced as the reserved bidder.

For the sixth block in the 2022/2023 Deep Offshore Licensing Round, codenamed PPL 306-DO, BISWAL Oil and Gas Limited was announced as the winning bid, while NNPC Exploration & Production Limited was announced as the reserved bidder.

FG awards 10 gas distribution licences

To ensure adequate gas utilisation for industrial growth, the federal government earlier this year awarded 10 Gas Distribution Licences to five top-tier firms, marking a significant leap towards deepening gas utilisation in Nigeria.

The beneficiary firms are: NNPC Gas Marketing Limited, Shell Nigeria Gas Ltd, AXXELA, NIPCO PLC, and Falcon Corporation Limited.

Minister of State for Petroleum Resources, Mr. Ekperikpe Ekpo, said the move reaffirms the government’s commitment to sustainable development of Nigeria’s vast gas resources.

Ekpo praised President Bola Ahmed Tinubu’s visionary leadership, which enabled the licence issuance, and appreciated the NMDPRA’s regulatory reforms under the leadership of the Authority Chief Executive, Mr. Farouk Ahmed.

The Minister said the issuance of the licences is expected to increase access to gas for domestic and industrial use, driving economic growth and development nationwide.

He said access to affordable and sustainable energy, like gas, is key to unlocking Nigeria’s entrepreneurial potential.

“This step is not just about meeting regulatory requirements; it is about building a future where gas serves as a foundation for economic growth, industrialisation, and improved quality of life for all Nigerians,” Ekpo said. “Our president gave gas its unique identity and has enabled several opportunities in the gas space. The gas industry has expanded rapidly in terms of business opportunities and governmental directives because of President Bola Ahmed Tinubu’s crucial position.”

The licences were issued in line with Section 148 of the Petroleum Industry Act (PIA) 2021, which mandates the NMDPRA to issue Gas Distribution Licences to qualified individuals and organisations. This move is part of the government’s efforts to implement the PIA and Gas Distribution Regulations of 2023.

The initiative is expected to open up opportunities across several key sectors, including energy-intensive industries, power generation, clean cooking initiative, gas reticulation, compressed natural gas mobility, and energy parks and special economic zones.

The Gas Minister said these opportunities align with the government’s vision of “Gas to Prosperity,” where natural gas plays a transformative role in fostering industrialisation, creating employment opportunities, and generating revenue for sustainable national development.

Decade of gas initiative

The Gas Distribution Licence framework is expected to promote accessibility and availability of gas, encourage infrastructure development, and enhance energy security for all Nigerians, Ekpo added.

Experts react

The National Public Relations Officer of the Independent Petroleum Marketers Association of Nigeria (IPMAN), Mr. Chinedu Ukadike, charged President Bola Tinubu to use the second half of his administration to fix the nation’s refineries located in Port Harcourt, Warri, and Kaduna.

He said a situation where all the state-owned refineries are dysfunctional remains a national embarrassment.

He added that bringing back the refineries on stream would prevent a monopoly in the downstream market.

He said the monopoly currently being experienced in the sector isn’t a welcome development because it stifles growth and doesn’t enhance competition.

Global energy research firm, Wood Mackenzie, has warned that the Nigerian National Petroleum Company Limited could see its oil and gas production slashed by as much as 50 percent by the late 2030s.

In its recent podcast titled “A New Era for NNPC and Nigeria’s Upstream Oil & Gas Sector,” the consultancy firm said NNPCL’s portfolio is burdened by a large number of sub-commercial assets, which pose long-term viability concerns.

The assessment comes in the wake of Mele Kyari’s exit as Group Chief Executive Officer and amid renewed targets set by President Bola Tinubu’s administration to boost Nigeria’s upstream sector.

Using its new upstream benchmarking tool, Woodmac’s team of experts, including Ian Thom, Research Director for Upstream; Neivan Boroujerdi, Director of Corporate Research; and Mansur Mohammed, Head of West Africa Upstream Content, highlighted that while short-term production may improve slightly, output is expected to peak by 2026 before declining steeply.

“What is unique to NNPC is that, unlike a lot of the other national oil companies within our corporate universe and around the world, most of its production and its assets are non-operated.”

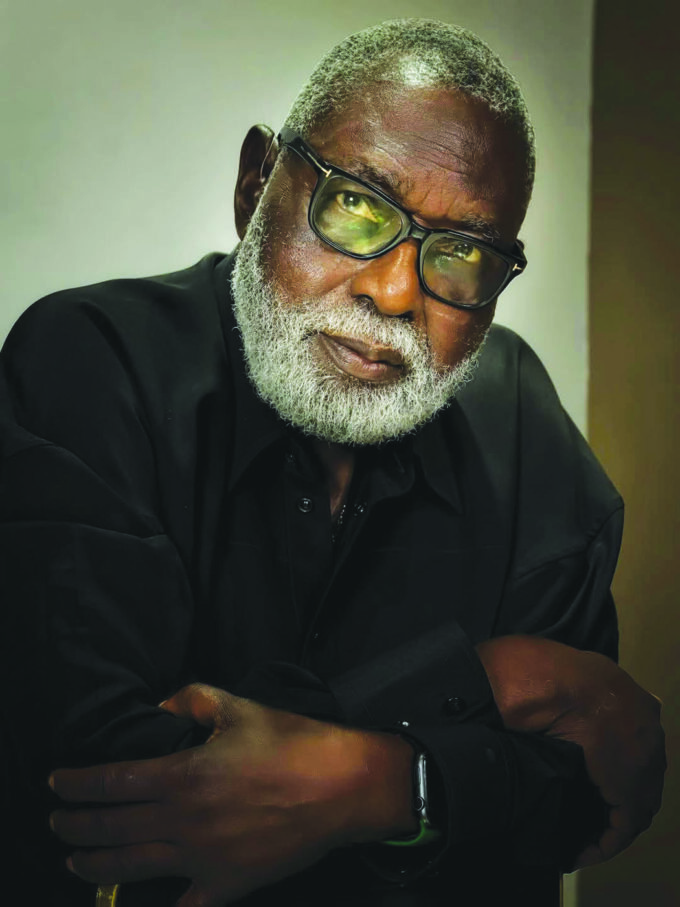

Chairman, Petroleum Technology Association of Nigeria (PETAN), Mr. Wole Ogunsanya, wants Nigeria to grow its oil production numbers in order to support the country’s weak refining capacity.

Ogunsanya said the country requires about 900,000 barrels per day (bpd) to meet its local refining capacity but is only capable of producing 1.8 million barrels bpd for both domestic requirement and export.

He said out of the 1.8 million bpd oil production, the Organisation of Petroleum Exporting Countries (OPEC) quota for Nigeria was 1.5 million bpd.

Giving a further breakdown of the crude oil requirement for domestic refineries, the PETAN Chairman said the Dangote refinery requires about 650,000 bpd, followed by the Nigerian National Petroleum Company (Limited) refineries with a capacity of 450,000 bpd but now requiring 200,000 bpd due to its limited capacity, and other modular refineries at about 50,000 bpd, bringing the total to 900,000 bpd.

“By the time the BUA refinery 350,000 bpd comes on stream by next year, the crude oil refinery demand for domestic refinery will shoot up. So for now, the country must begin plans to grow its oil production number to meet both local and export demand.”

The PETAN Chairman said for Nigeria to be in a comfortable stead, oil production must rise to about 2.5 million to 3 million barrels per day so that when the domestic crude oil requirement is met, the country would still have enough to export to make revenue.

However, Ogunsanya further identified another challenge in the country’s quest to attain 2.5 million bpd oil production.

“At the moment, we don’t have the infrastructure and equipment required to meet a daily oil production of 2.5 million bpd. The oil rigs, well services equipment, and pipelines are not available to support the level of this oil production. And these are all the things that PETAN is doing to build capacity by ensuring that the capacity is there for the industry to tap into.”

Leave a comment