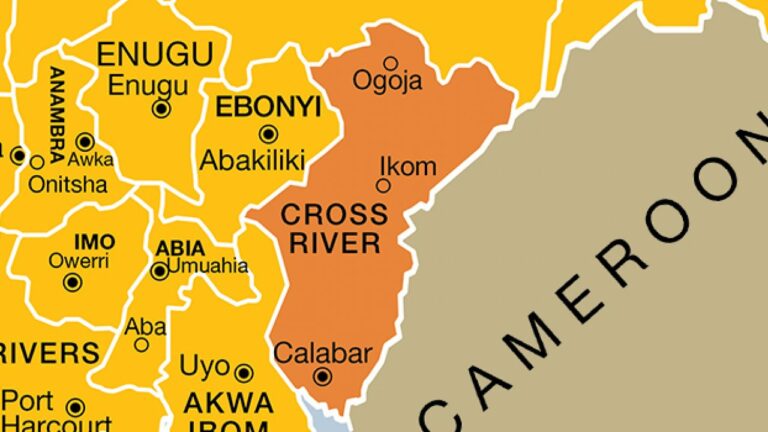

From Aniekan Aniekan, Calabar

Prince Edwin Okon, the Executive Chairman of the Cross River Internal Revenue Service, says the state has a tax gap of six billion naira.

The Chairman, who disclosed this during an interview in his office, said with various reforms being put in place, the state can bridge this gap and achieve a ten billion naira monthly tax revenue.

“There is room to do better because for us the tax gap for Cross River State is about six billion naira; currently, we do about three to four billion on a monthly basis.

“I’ve always said that this state has the potential to generate ten billion naira monthly with the right structures in place,” he said.

He also revealed that within two years, the tax revenue of the state has increased to ninety billion naira.

“If you compare June 2021 to June 2023, which is two years, the revenue was about 43 billion naira added together, that is 21 billion naira for 2021 and 22 billion naira for 2022.

“Looking at the period the governor came on board and gave us the opportunity to serve, between June 2023 to May 2025, we have already done about 90 billion naira.

“In our MDAs, for instance, we used to have about 4 billion annually, but as at December last year, we made about 17 billion naira,” he said.

He attributed the revenue surge to the support from the governor, particularly in the area of automation, and thanked him for not interfering with the revenue process.

He also welcomed the tax reform bills introduced by President Tinubu, which are currently before the National Assembly, saying they will help gather enough data to even look at the digital economy.

Leave a comment