•Africa needs urgent market overhaul -Popoola, NGX CEO

By Chinwendu Obienyi

In a troubling signal for Nigeria’s investment climate, both foreign and domestic investors withdrew a whopping N896.15 billion from the Nigerian Exchange Limited (NGX) between January and April 2025, Daily Sun’ investigations have revealed.

The outflows, which cut across institutional and retail segments, highlight mounting concerns over macroeconomic instability, persistent naira volatility, policy uncertainty and the country’s fiscal direction from key economic managers despite reforms undertaken by the federal government.

Furthermore, the global tension between the United States and its key trading partners have also contributed to the jittery disposition of investors.

According to data obtained from the Domestic and Foreign Portfolio Investment reports from January to April 2025, retail and institutional outflows reached N896.15 billion while inflows hit N840.80 billion in the review period.

The report, which is prepared on a monthly basis by NGX Regulation Limited, with trading figures from market operators on their domestic and foreign Portfolio Investment (FPI) flows further showed that institutional investors have consistently outperformed retail investors.

Specifically, institutional investors outperformed retail Investors marginally by 0.16 per cent, 8 per cent, 6 per cent and 14 per cent in the first four months of 2025, signifying that the market may gradually fail to serve as a level playing field, which could hinder inclusive economic growth and capital formation.

Reacting to the development, financial analysts and market operators attributed the outflows to “economic anxiety,” citing high inflation, slow policy execution, and uncertainty around interest rates and government fiscal direction.

They warned that Nigeria’s capital markets are “in need of a structural rejig,” urging policymakers to address FX instability and regulatory bottlenecks despite the raft of reforms undertaken by President Bola Tinubu.

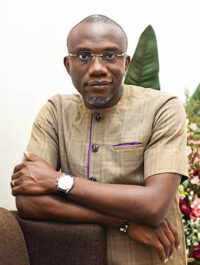

The Chief Executive Officer of Nigerian Exchange Group (NGX Group), Temi Popoola, called on African policymakers, capital market leaders and development stakeholders to collaboratively rethink the continent’s growth model, and anchor it on homegrown capital, tech-enabled integration, and bold partnerships.

Speaking at the 2025 Annual Meetings of the African Development Bank (AfDB) in Abidjan, Popoola emphasized that financial sovereignty and economic resilience must be built on deliberate domestic capital mobilization and scalable, tech-driven solutions.

Reflecting on lessons from the COVID-19 pandemic, he noted that, “When foreign capital dried up and domestic capital stepped in to fill the void, it revealed something powerful: the capital we often seek abroad already exists within our borders. What is needed now is intentionality and a clear plan to mobilise and deploy it effectively.”

Drawing on his leadership of one of Africa’s premier financial market infrastructure institutions, Popoola outlined three foundational pillars for Africa’s financial future: intentionality, financial literacy, and technology-driven inclusion.

He urged public and private institutions alike to “speak the language of capital” by designing frameworks that align with the realities and expectations of local investors. “Foreign capital follows local commitment,” he said. “When African institutions lead with clarity and confidence, others follow. But we must first trust and invest in ourselves.”

He also called for greater cross-border collaboration to accelerate the integration of African capital markets. Referencing the African Exchanges Linkage Project (AELP), an AfDB-backed initiative, he described it as a model for regional capital connectivity while cautioning that regulatory silos and uneven infrastructure remain barriers.

Leave a comment