-

Signs MoU to boost education tax

From Fred Ezeh, Abuja

The Nigeria Extractive Industries Transparency Initiative (NEITI) has signed a Memorandum of Understanding (MoU) with the Tertiary Education Trust Fund (TETFund) to enhance Nigeria’s education funding through accurate and timely remittances of education taxes from companies in the extractive sector.

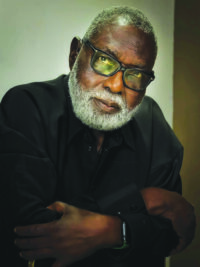

Speaking at the MoU signing in Abuja on Monday, June 16, 2025, NEITI Executive Secretary, Dr. Orji Ogbonnaya Orji, told journalists that the extractive sector has significantly contributed to education funding through TETFund, and the MoU aims to achieve even greater impact.

He said, “This MoU connects the source and the application of public revenues. In NEITI, it’s our duty to track and verify what is paid, while TETFund ensures that what is received is invested for impact. Together, we are creating a value chain of accountability from extraction to education.

“Allow me to share some key figures from NEITI’s audited industry reports covering the last five years: In 2022, total revenue accruals to TETFund stood at ₦322.99bn. In 2023, that figure rose significantly to ₦571.01bn, the highest annual inflow to date. From 2019 to 2021, NEITI audit data shows that total accruals (not remittances) to TETFund amounted to ₦644.19 billion, of which ₦624.32 billion was disbursed.

“This means that within the last five years alone (2019–2023), total revenue accruals to TETFund from education tax reached approximately ₦1.024 trillion, highlighting the centrality of the extractive sector in financing Nigeria’s tertiary education.

“These funds are drawn from the profits of companies in oil, gas, mining, manufacturing, telecommunications, banking, and other sectors, many of which fall within NEITI’s audit purview.

“There is no better use of extractive revenues than to invest them in the education of our people. No country achieves prosperity by merely exporting crude resources. The true wealth of any nation lies not beneath its soil but in the minds of its people.

“By supporting tertiary education, research, and innovation, TETFund plays a pivotal role in converting finite mineral resources into infinite human capital.”

Dr. Orji explained that the MoU ensures NEITI’s verified data will feed directly into TETFund’s strategic planning, revenue forecasting, and accountability framework. “Under the MoU, NEITI will work with TETFund to ensure timely and prompt remittances through early deployment of evidence-based data.

“NEITI will also provide real-time information on revenue accruals due to TETFund to guarantee transparency and support the Fund in tracking remittances and utilisation. Our joint effort will uplift educational institutions, enhance access to scholarships, and strengthen the research ecosystem across our public tertiary institutions,” he added.

He stressed that the over ₦1.5 trillion accrued to TETFund in the past five years must be fully accounted for, efficiently deployed, and transparently tracked to translate into modern libraries, functional laboratories, revitalised lecture halls, and cutting-edge research.

“With this MoU, NEITI and TETFund have committed to a future of joint accountability, open data exchange, and measurable impact. This is not just a partnership between two institutions. It is a covenant with the Nigerian people. A promise to ensure that Nigeria’s natural resource wealth truly works for every citizen, especially through education,” he said.

TETFund Executive Secretary, Sonny Echono, commended NEITI’s commitment to education funding and addressed concerns about the impact of upcoming tax reforms.

He said: “In the new tax law, there’s a change in nomenclature. It’s now development levy instead of education tax. However, TETFund will receive 50 per cent of the development levy. So, it’s the same procedure and parameter.

“However, this MoU with NEITI will provide a framework for us to track funds. There’s also a system in the new tax law to monitor inflows and verify actual accruals. This will ensure that we monitor the companies, their compliance levels, as well as the efficiency of collection.”

Leave a comment