• as global experts urge tax sovereignty, debt reform, grassroots inclusion to achieve equitable public finance and social justice

From Juliana Taiwo-Obalonye, Abuja

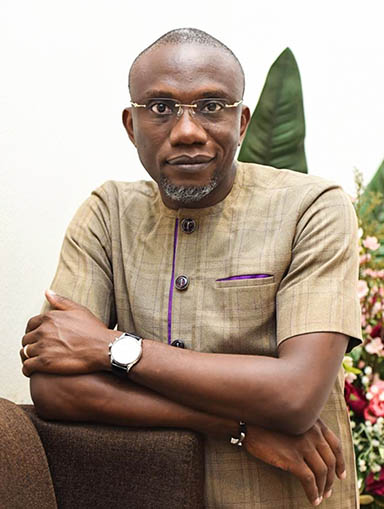

At the Fourth International Conference on Financing for Development (FFD4) summit in Seville, Spain, a member of Nigeria’s Presidential Fiscal and Tax Reform Committee, Uche Uwaleke, has declared that Nigeria’s sweeping tax reforms are poised to unlock trillions of naira for investment in vital public services, marking a turning point in the nation’s fiscal future.

Speaking on “Promoting domestic resource mobilisation for the fulfilment of human rights: The case of Nigeria’s tax reforms”, he said explained that the new laws are expected to raise Nigeria’s tax-to-GDP ratio to 15% by 2027.

Addressing delegates at the at the Bridging the Gap: Linking Financing Solutions to Public Services Organised by Global Initiative for Economic, Social and Cultural Rights (GI-ESCR), and the Fourth International Conference on Financing for Development (FFD4) summit in Seville, Spain, Uwaleke explained that the sweeping tax reforms recently enacted by the Nigerian government, is a “turning point for Nigeria’s development and a foundation for fulfilling the country’s human rights obligations.”

He described the reforms as “a bold, pro-development agenda that will create the fiscal space needed to transform the lives of millions of Nigerians.”

“For a country like Nigeria — with a young, dynamic population and vast developmental needs — how we mobilize and allocate domestic resources directly impacts our ability to fulfill human rights obligations,” he stated.

Uwaleke argued that the new tax regime is not just about revenue, but about “building the fiscal capacity for government to meet its social contract with citizens and, by extension, human rights obligations.”

According to him, the reforms, signed into law by President Bola Tinubu, overhaul Nigeria’s tax system by consolidating multiple taxes, introducing digital-first administration, and exempting small businesses with annual turnover below ₦50 million from corporate income tax. “These reforms aim to raise Nigeria’s tax-to-GDP ratio to 15% by 2027, freeing up ₦6-8 trillion annually for critical services such as education, healthcare, and infrastructure,” Uwaleke revealed.

The new laws also introduce a progressive personal income tax regime, expanding reliefs for low-income earners and exempting workers earning up to ₦800,000 annually from personal income tax.

“Taxation, when structured equitably and deployed effectively, is a powerful tool to reduce inequality and realize the rights enshrined in our Constitution and the Sustainable Development Goals,” Uwaleke said.

Other key features include a reduction in corporate tax rates for larger firms, a harmonized system to reduce business harassment, and the digitalization of tax processes to improve compliance and transparency. “By streamlining tax collection and leveraging technology, we are not only boosting revenue but also restoring public trust and supporting business growth,” he emphasized.

According to him, international observers have welcomed the reforms as a foundation for inclusive growth and fiscal sustainability, with the IMF and World Bank noting that the measures could improve Nigeria’s credit outlook and attract foreign investment. “We are showing that Nigeria is truly ready and open for business. Easy in, easy out,” President Tinubu had remarked at the signing ceremony.

He added “These reforms are pro-development, pro-people, and pro-rights. By unlocking trillions in new revenue, we can finally invest at scale in the public goods that underpin a just and prosperous society for all Nigerians.”

He noted that Nigeria, Africa’s largest economy, has historically struggled with a fragmented tax system, a low tax-to-GDP ratio of about 10%, and an over-reliance on volatile oil revenues. Uwaleke noted, “Despite our economic size, our tax base is narrow, and the informal sector dominates, leading to significant leakages and inefficiencies. These structural weaknesses have limited our ability to finance public goods and fulfill our obligations to citizens.”

He added that the reform package includes four landmark laws: the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service Act, and the Joint Revenue Board Act. Together, these laws consolidate and repeal multiple existing tax statutes, streamline the tax system, and introduce a unified, digital-first approach to tax administration.

“The overarching objective of the Act is to streamline Nigeria’s tax system by reducing the number of taxes to a manageable single-digit figure,” Uwaleke explained. “This reform is aimed at enhancing revenue generation, simplifying compliance procedures, and addressing regional disparities in tax administration.”

Key features of the reforms include the harmonization of taxes to eliminate duplication and inefficiency, the introduction of a single taxpayer identification number for individuals and businesses, and the digitalization of tax reporting to reduce opportunities for corruption. Small businesses earning less than ₦50 million annually are now exempt from corporate income tax, while the corporate tax rate will gradually fall from 30% to 25% by 2026. The reforms also recalibrate Value Added Tax (VAT) sharing to benefit states and local governments while protecting minimum wage earners from personal income tax.

President Tinubu, at the signing ceremony, declared, “We have opened the door for new economic and business opportunities. We are showing that Nigeria is truly ready and open for business. Easy in, easy out.” He described the reforms as a decisive shift in Nigeria’s fiscal direction, designed to “unify our fragmented tax system, eliminate wasteful duplications, cut red tape, restore investor confidence, and entrench transparency and coordination at every level.”

He concluded by saying, “These reforms are pro-development, pro-people, and pro-rights. By creating the fiscal space needed, we can uphold the rights of all Nigerians and invest in the country’s future.”

Also speaking, Director for Advocacy and Research at the Tax Justice Network, Liz Nelson, on the topic, progressive tax reforms to finance public services and care societies, emphasised the critical concept of tax sovereignty—the ability of nation-states to set and enforce their own tax policies without external interference. She explained that current international tax rules, rooted in outdated neoliberal principles known as the “tax consensus,” undermine countries’ ability to raise adequate revenue. Nelson said: “Wealth is largely uncounted, and wealth is largely hidden… Global revenue losses in 2024 are estimated at $492 billion due to offshore wealth and profit shifting by multinationals. This figure is just the tip of the iceberg.”

She called for a dramatic shift in international tax cooperation, advocating for reforms such as mandatory exchange of financial account information without onerous reciprocity, beneficial ownership registries, and country-by-country profit reporting by multinationals. Nelson stressed:

“We need a transformative global financial and tax architecture that provides social justice… Tax sovereignty is the ability of states to set and enforce their own policies in their sovereign interest, without external interference.”

Head of Programs and Influencing at ActionAid International, David Archer, speaking on Impact of tax, debt and austerity policies on the financing of quality public services, linked the tax justice struggle with the global debt crisis, calling the current international debt architecture “rooted in the colonial era” and unfit for purpose. He highlighted the disproportionate debt burden on African countries, which pay exorbitant interest rates compared to wealthy nations, despite the global financial system enforcing debt repayments. Archer stated:”54 countries are in debt crisis. 75% of countries spend more on debt servicing than health, and 50% more than education. This is fundamentally because of a colonial and racist architecture.”

He called for a UN Framework Convention on Debt to establish responsible lending and borrowing rules and a fair debt workout mechanism independent of the IMF’s coercive influence. Archer criticized the IMF’s austerity policies that consistently recommend cutting public sector wages—often affecting teachers and health workers—thereby undermining public services. He urged: “-National governments need to resist coercive IMF advice, declare climate and public service emergencies, and demand that debts owed to them by rich countries—such as climate debt—be recognized and repaid.”

Director of International Programs at the International Budget Partnership (IBP), Jennifer Grant, delivered a compelling call for a transformation in the way public finance is governed.

Grant urged leaders and practitioners to look beyond technical solutions and confront the political realities that shape fiscal policy.

“It’s amazing how often you can be in a public finance space and nobody talks about power. Or politics, or God forbid, the public. Public finance without the public,” Grant remarked, highlighting the frequent disconnect between fiscal policy discussions and the communities they affect. She emphasized that budgets are not neutral documents but instead reflect the underlying power dynamics of society. “Public finance is not neutral. It’s a mirror of power—who has it, and who doesn’t. Decisions about where you put your money, regardless of how much you have, is a political negotiation.”

Grant warned that simply increasing fiscal space, whether through higher taxes or reduced debt repayments, does not automatically translate into greater investment in public services. “We can’t assume that even if we increase the fiscal space, even if we increase tax and lower debt repayments, that that will automatically mean that we have greater investment in public services,” she cautioned. “All too often, public finance is a system that creates and perpetuates inequality.”

She called for a fundamental shift in how fiscal governance is approached, beginning with the inclusion of new actors. “All over the world, we’ve got grassroots communities who rely on service delivery and have very little voice and visibility in those negotiations,” Grant said. She pointed to IBP’s work with “2 million smallholder women farmers in Nigeria” and “300,000 women fisherfolk in Indonesia,” who have not only participated in but led highly effective reform coalitions.

Grant stressed the importance of understanding who holds power in fiscal policy and how these dynamics perpetuate exclusion. “We have to diagnose power dynamics—who has it, and who doesn’t? And how fiscal policies reproduce exclusion. We can then identify the levers and choose reforms that, if we succeed, will shift power in sustainable ways.”

She advocated for the creation of new governance hubs, bringing together government, the private sector, media, and social movements. “Movement shouldn’t only have the option to shut down roads and demonstrate and mobilize in that way. They are also governance actors—actors that can be in hubs that make these changes.”

Grant also called for a broader understanding of what counts as evidence in fiscal policy. “Evidence has been associated with institutions often removed from realities on the ground, and lived experiences are not valued. The people that wait in queues in clinics, the people who know that their children can’t access schools, they have crucial service delivery information. And it needs to be institutionalized, and it needs to be used in planning, in budgeting for the implementation of services.”

She challenged persistent myths, such as the belief that the poor do not pay taxes or that uneducated communities cannot be effective advocates for budget reform. “You may need a mechanic sometimes, but you don’t need to be a mechanic to drive a car. And you definitely don’t need to be an economist to be a really important reform actor in shifting fiscal justice.”

Grant illustrated her points with real-world examples. In South Africa, she described how community facilitators in informal settlements helped secure a significant increase in funding for sanitation, benefiting millions of residents. In Indonesia, women with disabilities achieved policy changes to make reproductive healthcare more accessible. In Senegal, health volunteers who had long been excluded from planning are now participating in district health committee meetings, influencing how services are delivered and funded.

“We have to acknowledge that this is a deeply political area, that technical solutions and organizations will not get this reform alone. We have to shift power and engage with movements. Recognize them, not just as data collectors, but as governance actors, as reform actors,” Grant urged.

She concluded with a call for funders, governments, and international organizations to partner with and support grassroots movements, institutionalize community-led evidence, and create inclusive decision-making spaces at all levels. “Transforming how services are financed is not just about reallocating budget lines. We have to redefine how governance works in countries. We need to create a culture of public accountability for public resources that is rooted in lived experience, in collective agency, in grassroots power. And in doing so, we won’t just get better services—we’ll get more democratic and responsive states.”

Leave a comment