•Floats N50bn scheme for community contractors

By Adewale Sanyaolu

The Nigerian Content Development and Monitoring Board (NCDMB) has commenced the enforcement of the Nigerian Content Fund Clearance Certificate (NCFCC) to grow both indigenous capacity in the oil and gas sector and the $400m Nigerian Content Intervention Fund (NCIF).

The Board equally floated a revised N50 billion Community Contractor Fund to remove access barriers and increase participation by genuine community contractors.

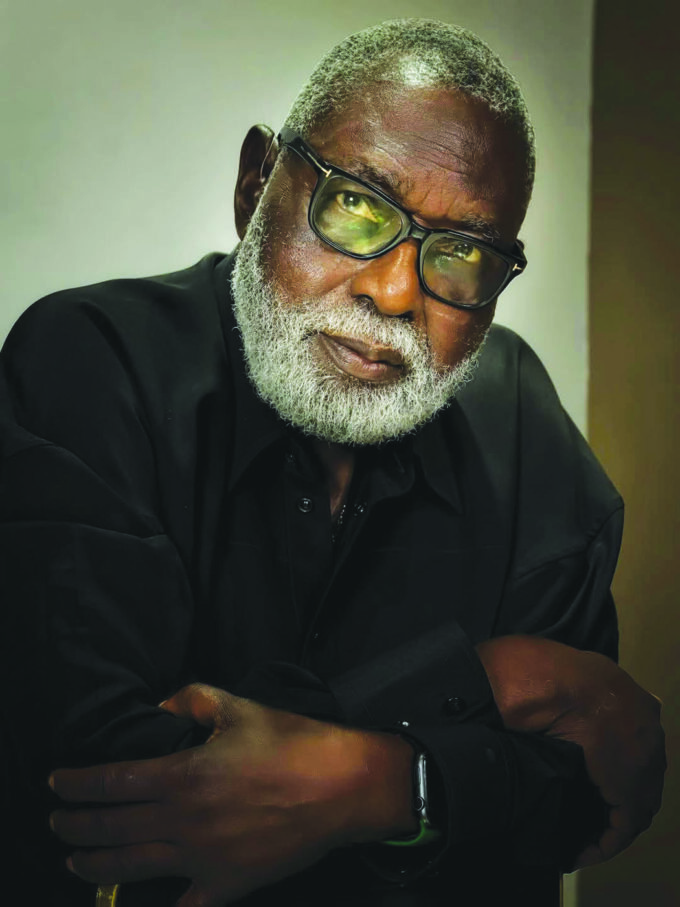

Executive Secretary of NCDMB, Mr. Omatshola Ogbe, unveiled the initiatives at the Nigerian Content Intervention Fund (NCIF) sensitisation workshop in Lagos yesterday.

Represented by the Acting Director, Finance and Personnel Management, Mr. Mubarak Zuabair, Ogbe said the NCFCC was developed to ensure that Nigerian Content requirements are met in all oil and gas projects.

“With the introduction of the Compliance Certificate, companies now have an objective standard to demonstrate conformity, while the Board is better positioned to ensure regulatory oversight. We understand that for this system to be effective, stakeholders must be adequately informed. This programme, therefore, provides an opportunity for hands-on engagement and clarification.”

Similarly, he added that the upgraded NCDF payment portal is a major step forward in our drive for efficiency.

According to him, the enhancements made to the platform are aimed at improving user experience, simplifying remittance processes, and ensuring real-time compliance tracking, adding that with the expected increase in inflow to the Fund following the implementation of compliance certification, the upgrade could not have come at a better time.

He maintained that the revised Community Contractors Finance Scheme is a bold reimagination of NCDMB’s support for host community contractors.

“Through our collaboration with FCMB and other financial institutions, we have redesigned the product to remove access barriers and increase participation by genuine community contractors. This initiative is directly aligned with our strategic objective of enabling shared prosperity and inclusive growth in the Nigerian oil and gas ecosystem.

We will be highlighting, during this workshop, some of the prospects and challenges associated with managing and accessing the Nigerian Content Intervention Fund.

It is, however, good to note that the combined $400 million NCI Fund managed by BOI and NEXIM has been quite instrumental to the development of local capacity in the industry.

As of today, about 130 companies have accessed and benefited from this Fund across the various product lines. Work is, however, ongoing to ensure more indigenous companies in the industry have access to the Fund.

As we proceed through today’s sessions, I urge you to actively participate, share your insights, ask questions, and take full advantage of the wealth of knowledge to be shared by our resource persons and facilitators.

Let me also use this opportunity to express our appreciation to all our partners — Vascon Solutions, FCMB, NEXIM Bank, BOI, and the implementing consultants — for their continued collaboration and support.

Together, we are building systems and solutions that work not only for today but for the future of Nigerian Content.”

UBA Business Series Targets MSMEs’ Growth through Building Strong Partnerships

Africa’s Global Bank, United Bank for Africa (UBA) is set to host another edition of its highly anticipated quarterly Business Series, with a strong focus on empowering Micro, Small, and Medium Enterprises (MSMEs) to build strong businesses that will drive lasting impact across the continent.

This quarter’s session, which is the second for 2025, will hold on Thursday, July 10, 2025 at the UBA House, Marina, Lagos, and is part of the bank’s broader commitment towards business development and financial inclusion. The UBA Business Series aims to equip small business owners and entrepreneurs with practical strategies to build resilient partnerships, unlock funding opportunities, and navigate the evolving business landscape.

With the theme, “Stronger Together: Building Powerful Business Partnerships for Progress, this edition of the Business Series will bring together seasoned business leaders, industry experts, and successful entrepreneurs who will share insights on how collaboration and strategic alliances can help MSMEs overcome growth barriers.

An exciting lineup of seasoned business owners including Beauty Entrepreneur, Dabota Lawson; Real Estate Mogul and Entrepreneur, Wale Ayilara; Fashion Entrepreneur, Mai Atafo, and Journalist and TV producer Peace Hyde, will be on ground to arm participants with the tools and network they need to thrive in today’s competitive environment.

The session will be accessible both physically and virtually, allowing broader participation from the business community as interested participants can register ahead via the following link: on.ubagroup.com/BusSeriesPress

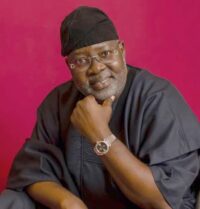

Speaking ahead of the event, UBA’s Group Head, Retail and Digital Banking, Shamsideen Fashola, highlighted the critical role of partnerships in today’s dynamic business environment.

“In an increasingly interconnected world, the power of collaboration cannot be overstated. At UBA, we recognise that collaboration is the cornerstone of sustainable business success. The ‘Stronger Together’ Business Series is designed to inspire entrepreneurs and corporate leaders to forge meaningful alliances that drive progress, unlock opportunities, and contribute to Africa’s economic transformation,” Shamsideen said.

Also speaking, the Group Head, Corporate and Marketing Communications, Alero Ladipo, emphasised the UBA’s commitment to empowering the business community through knowledge sharing.

“The quarterly series represents our dedication to nurturing entrepreneurship and fostering an ecosystem where businesses can thrive through strategic collaborations. Our speakers represent diverse industries and have successfully leveraged partnerships to scale their businesses, create jobs, and drive innovation.”

The UBA Business Series is a knowledge-sharing platform created by United Bank for Africa to empower entrepreneurs and small business owners with the tools, strategies, and insights needed to grow and sustain their businesses.

United Bank for Africa is one of the largest employers in the financial sector on the African continent, with 25,000 employees group wide and serving over 45 million customers globally. Operating in twenty African countries and the United Kingdom, the United States of America, France and the United Arab Emirates, UBA provides retail, commercial and institutional banking services, leading financial inclusion and implementing cutting-edge technology.

Leave a comment