From Adanna Nnamani, Abuja

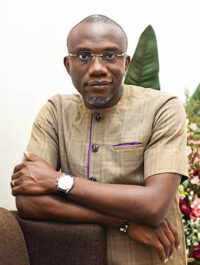

Chairman of the Board of Directors of BUA Cement Plc, Abdul Rabiu, has assured Nigerians that the price of cement will drop as the naira continues to stabilise against the dollar.

Rabiu, who spoke at a press briefing after the company’s Annual General Meeting (AGM) on Monday in Abuja, said although Nigerians have expressed concerns about the rising cost of cement, most of the current prices are linked to the impact of foreign exchange volatility on production costs.

He said the company’s expansion plans, energy cost reductions, and the federal government’s ongoing reforms in the forex market are expected to bring down cement prices in the near future.

“At N10,000 per bag, I do not think the price is high, considering the exchange rate moved from N300 to over N1,000 to the dollar. Even when it was N300, cement was N4,000 to N5,000. So if you look at it, this is not exploitation,” Rabiu said.

He explained that most of the company’s expansion projects were committed when the exchange rate was about N400 or N500 per dollar, but by the time the projects matured, the dollar had skyrocketed to nearly N2,000 at some point.

According to him, that directly impacted capital costs, raw material imports, and energy expenses, leaving companies like BUA exposed to huge losses if prices are not adjusted.

“Before, we had to go to the central bank to get forex. That has now changed. Now all the banks have foreign exchange, and the dollar rate is the same. Whatever rate I get today is what you get. Before, it was not like that,” he said.

Rabiu said he remains optimistic that the naira will strengthen further to between N1,000 and N1,300 to the dollar, noting that when that happens, cement prices will reduce accordingly.

He added, “So, the prices you are seeing now are real prices, not anticipation prices. Things are getting better. At one point, the dollar hit N2,000 to N1, but now it’s around N1,500. And I’m optimistic that it will get to N1,000 to N1,300, or even lower. When that happens, cement prices will come down too.

“Look at food prices, they are also coming down. We just need to be patient; things will get better.”

He also revealed that BUA Cement is finalizing a major expansion project expected to be commissioned next year. The new three-million-ton line will raise the company’s total capacity to about 20 million tons per annum by first quarter of 2027.

On the company’s profit performance, Rabiu disclosed that BUA Cement posted N81 billion after-tax profit in the first quarter of 2025. He said if this trend continues, the company could close the year at N250 billion after tax.

He however maintained that the company has invested billions of dollars over the last decade, and needs to make reasonable returns to sustain operations, pay workers, and satisfy shareholders.

“We are not in this to lose money. We have invested heavily over the years, and we have to keep the business running while ensuring prices remain as fair as possible given the current economic realities,” he said.

Rabiu also pointed out that new energy plans are underway to further cut production costs and reduce BUA Cement’s environmental footprint.

The company delivered strong financial results in 2024, with revenue rising by 90.5 percent to N876.5 billion and net profit before tax growing by 48.2 percent to N93 billion. EBITDA increased to N268.6 billion, despite higher foreign exchange losses of N9.3 billion due to currency devaluation. Return on capital improved to 15 percent, while earnings per share rose to N2.18.

The company proposed a final dividend of N2.05 per share, reflecting a 94 percent payout ratio and continued confidence in its financial strength.

Leave a comment