From Adanna Nnamani, Abuja

The federal government has fully settled over N2 trillion in outstanding capital budget commitments from the 2024 fiscal year, leaving no pending obligations unprocessed.

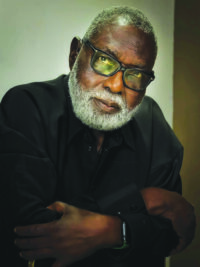

Finance and Coordinating Minister of the Economy, Wale Edun, announced the payment on Thursday at a ministerial press briefing in Abuja.

Edun said the settlement was made in the last quarter to contractors handling various projects from the previous year. He added that the focus would now shift to 2025 capital releases.

He stressed that government agencies must adhere to spending protocols and only enter binding commitments when funds are duly authorised.

The Minister also disclosed that the Tinubu administration has been making consistent repayments of deductions owed to the Federation Account, boosting the fiscal position of states and enabling them to operate in surplus.

He explained that this has increased states’ capacity to invest, with much of the expenditure channelled into capital projects.

On the broader economy, Edun reaffirmed the administration’s medium-term target of achieving 7 percentage annual GDP growth through increased public and private sector investments, job creation, and higher incomes.

He said the strategy would focus on attracting private capital and expanding public-private partnerships across key sectors such as agriculture, education, health, manufacturing, and technology.

He listed the fiscal stability targets to include a 3.5 percentage fiscal deficit-to-GDP ratio, debt-to-GDP of 60 percentage, tax-to-GDP at 18 percentage, and revenue-to-GDP less than 50 percentage.

According to him, the government’s economic plan is anchored on a stable macroeconomic environment that encourages private investment and a stronger public savings effort to fund critical infrastructure, health, education, and agriculture.

Edun added that Nigeria is taking advantage of a competitive exchange rate to diversify exports under the African Continental Free Trade Agreement (AfCFTA).

“In the last quarter, we did pay to contractors over N2 trillion to settle outstanding capital budget obligations. That is from last year.

“At the moment, we have no pending obligations that are not being processed and financed. And the focus will now shift to 2025 capital releases.

“There is an important stakeholder engagement going on re-emphasising the orderliness and for efficiency that despite appropriation, it is when authorized or when funds are made available and authorized for spending that government entities that are procuring should enter into binding commitments of government.

“Since the first half of 2023, the combined fiscal balance of the states has grown from 1.8 percentage of GDP to 3.1 percentage — that is from N2.8 trillion to N7.1 trillion which is a surplus. That means that the states have been provided funding that has now allowed them to be in surplus.

“And of course, that gives them the greater capacity to invest. From economic standpoint, it must be said that the increase in spending of the states has in fact gone into capital expenditure.

“To achieve these, we are looking attract private sector investments and expand PPP arrangements across agriculture, education, health, manufacturing, and technology.

“Our fiscal stability target include: 3.5 percentage of GDP as fiscal deficit; revenue-to-GDP less than 50 percentage and debt-to-GDP of 60 percentage and tax-to-GDP at 18 percentage tax revenue.

“First, to achieve a stable macroecomic environment where private sector investments can thrive and be sustained indeed across all sectors. And secondly, to build a stronger government, is public saving effort. So, that there is funding for critical investments in education, health, and infrastructure as well as agriculture as the foundational pillar for rapid, sustained and inclusive growth.

“We have a competitive exchange rate and other conditions which allows us to diversify our exports particularly under the African Continental Free Trade Agreement (AfCTA).”

Leave a comment