By Chinwendu Obienyi

Nigeria’s banking sector is currently awash with cash, but experts say the flood may not be good news.

In just two weeks, liquidity in the system has ballooned to N3 trillion, raising concerns that the financial market could be thrown off balance.

Findings by Daily Sun reveal that the surge is largely fuelled by recent Federal Account Allocation Committee (FAAC) payouts, the maturity of Open Market Operations (OMO) instruments and treasury bill rollovers.

While this sounds positive on the surface, too much idle cash in the system can distort interest rates, weaken the Central Bank of Nigeria’s (CBN) ability to control inflation and make it harder to maintain financial stability. In simple terms, banks with excess cash may struggle to lend wisely, while the CBN could be forced to tighten controls to mop up liquidity, a move that often leads to higher borrowing costs for businesses and individuals.

Analysts note that the coming weeks will test the resilience of both banks and the CBN. “It’s like water overflowing a dam, if not properly managed, it can flood the entire community,” one market watcher explained and stressed the risks of inflation and market volatility if the surge is not contained.

System liquidity remained firmly in surplus last week, closing at a net positive balance of about N2 trillion, even as the Central Bank of Nigeria (CBN) and the Debt Management Office (DMO) attempted to drain excess cash through OMO and NTB auctions. Despite these mop-up efforts, interbank funding conditions stayed relatively tight. The OPR was flat at 26.50 per cent, while the Overnight Repo rate inched up 5 basis points (bps) to 27.00 per cent.

The money market closed the last week of August on a liquid footing as N2 trillion in FAAC inflows and N350 billion in OMO maturities combined to lift system liquidity to a net positive balance above N1 trillion.

Analysts say the anticipated liquidity surge could ease short-term funding costs for banks, but it also sets up a fresh test for the Central Bank of Nigeria (CBN), which has worked aggressively to sterilize excess cash in recent months to rein in inflationary pressures and stabilize the naira.

In the interbank market, traders expect overnight rates to moderate further from current levels in the high-20 per cent band. “When liquidity climbs to this level, banks are naturally more comfortable meeting their obligations, and we should see rates like OPR and Overnight NIBOR soften. But the CBN will not allow conditions to loosen too much, so we expect more OMO auctions or special bills to drain the system”, a fixed income trader at one of the tier-1 banks said.

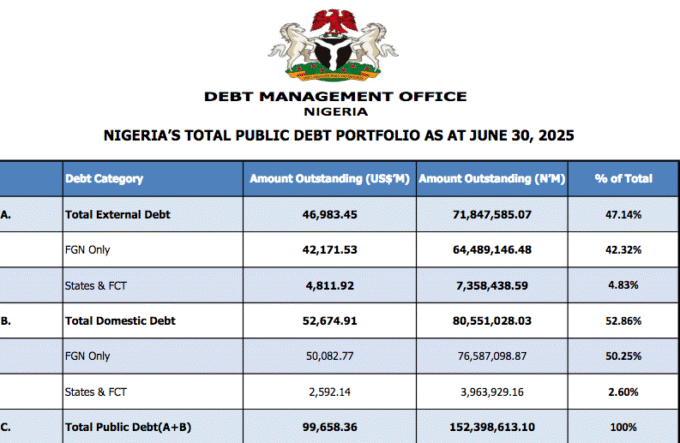

The treasury bills market could face mixed pressures. On the one hand, liquidity comfort is likely to spur demand, particularly at the short end of the curve, compressing yields. On the other hand, the Debt Management Office (DMO) may take advantage of the liquidity glut to issue more paper at the longer end, keeping yields sticky or even edging them higher. The interplay between strong demand and heavy supply will determine the near-term trajectory of yields.

For banks, the liquidity surge presents both opportunities and trade-offs. Cheaper interbank funding will reduce short-term borrowing costs but could also compress net interest margins, since returns from placing idle funds in the interbank market will be lower. However, Vice Chairman, Board, Highcap Securities Limited, David Adonri, said, the sector could benefit from trading gains if yields in the treasury bills market ease meaningfully on the back of strong demand.

“This is a sweet spot for banks. They are unlikely to face refinancing risks, and they can take tactical positions in government securities to boost trading income. But the CBN’s liquidity mop-up operations will be the swing factor”, Adonri said.

Still, the broader macroeconomic implications are more nuanced. A system flush with N3 trillion in liquidity heightens the risk of inflationary spillovers, particularly if cash filters into consumer spending or foreign exchange demand. This is why market participants expect the CBN to maintain a tight grip through frequent liquidity sterilization.

“The banking system will enjoy comfort in the short run, but the bigger concern is what this means for inflation and exchange rate stability. We may see more volatility in yields and funding rates as the CBN tries to strike a balance”, Adonri noted.

Ultimately, while the banking sector stands to benefit from improved liquidity conditions, the sustainability of these gains will depend on how aggressively the apex bank responds.

For now, the expectation of a N3 trillion liquidity balance signals comfort for banks, but also underlines the ongoing tug-of-war between liquidity surpluses and monetary tightening in Africa’s largest economy.

Leave a comment