By Chinwendu Obienyi

Nigeria’s public debt burden is poised to decline for the first time in more than a decade, buoyed by stronger economic growth and a steadier exchange rate, according to the World Bank.

In its latest Nigeria Development Update (NDU) report, titled “From Policy to People: Bringing the Reform Gains Home,” released on Wednesday, the Washington-based lender said the country’s debt-to-GDP ratio is projected to fall from 49.2 per cent in 2024 to 39.8 per cent in 2025.

The report attributed the improvement to fiscal resilience, stronger output, and a more stable naira.

“Fiscal resilience, stronger growth, and exchange rate appreciation have helped ease debt pressures,” the World Bank said. “The debt service-to-revenue ratio has also dropped significantly to levels not seen in many years.”

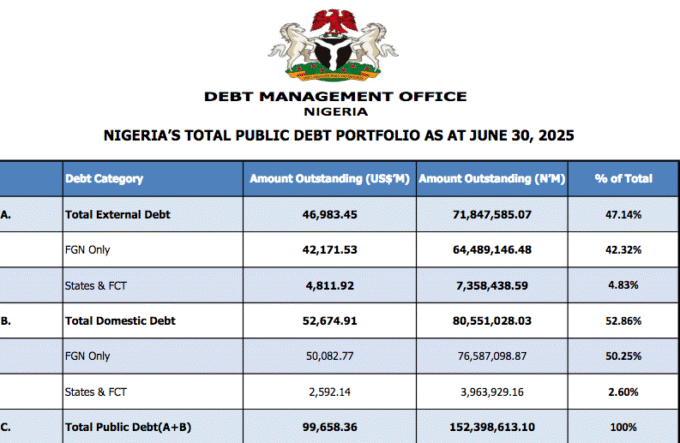

The decline would mark a turning point for Africa’s largest economy, where public debt has ballooned over the past decade amid weak revenue performance and heavy borrowing to finance subsidies and budget shortfalls. As of the first quarter of 2025, Nigeria’s total public debt stood at N149.39 trillion ($110 billion), up from N121.67 trillion in December 2024, according to government data. Much of the increase was driven by a previously weak naira that inflated the local-currency value of external obligations.

Yet the World Bank says a combination of stronger growth, driven by improved productivity and non-oil exports and a more stable currency is now helping to reverse the trend. Economic growth accelerated to 4.23 per cent in the second quarter of 2025, its fastest pace in five years, while the naira has remained relatively steady after months of volatility following the government’s exchange rate unification in 2023.

Nigeria’s external position has also strengthened. The World Bank estimates that foreign reserves now exceed $42 billion, supported by a current account surplus of 6.1 percent of GDP, underpinned by rising non-oil exports and reduced imports of refined petroleum products following the start-up of domestic refining capacity.

“On the fiscal side, despite lower oil prices, the federal deficit is projected at 2.6 per cent of GDP in 2025, broadly unchanged from 2024, while public debt is expected to decline for the first time in over a decade—from 42.9 to 39.8 per cent of GDP,” the report said.

However, the Bank cautioned that macroeconomic stability has yet to translate into meaningful improvements for most Nigerians. Poverty and food insecurity remain widespread, and inflation, though easing, is still among the highest in Africa.

Inflation is projected to average 22.1 per cent in 2025, down from 26.3 per cent this year, as the Central Bank of Nigeria’s tighter monetary stance begins to anchor expectations. “Sustained monetary discipline and structural reforms are needed to tackle food prices—the biggest tax on the poor,” Samer Matta, the World Bank’s Senior Economist for Nigeria, said.

Food inflation remains a key pressure point. According to the NDU, the cost of a basic food basket has risen fivefold between 2019 and 2024, hitting households that spend as much as 70 per cent of their income on food.

“The Nigerian government has taken bold steps to stabilize the economy, and these efforts are beginning to yield results,” World Bank Country Director for Nigeria, Mathew Verghis said, “But macroeconomic stability alone is not enough. The true measure of success will be how these reforms improve the daily lives of Nigerians, especially the poor and vulnerable.”

The World Bank noted that ongoing reforms, such as fuel subsidy removal, exchange rate liberalization, and fiscal consolidation, are addressing deep-seated distortions that have long constrained growth.

However, the lender warned that without targeted social protection measures, the short-term pain could undermine public support for reform.

“Sustained progress in livelihoods will depend on continued efforts to reduce inflation, foster inclusive growth, strengthen public services, and expand support for the most vulnerable,” the Bank said.

The Nigeria Development Update is one of the World Bank’s flagship reports on the country, providing biannual assessments of economic trends, policy developments, and risks to inclusive and sustainable growth.

If the Bank’s projections hold, 2025 could mark a rare year in which Nigeria’s fiscal and external indicators move in the right direction, offering some relief after a decade of rising debt and eroding household welfare.

Leave a comment