By Uche Usim

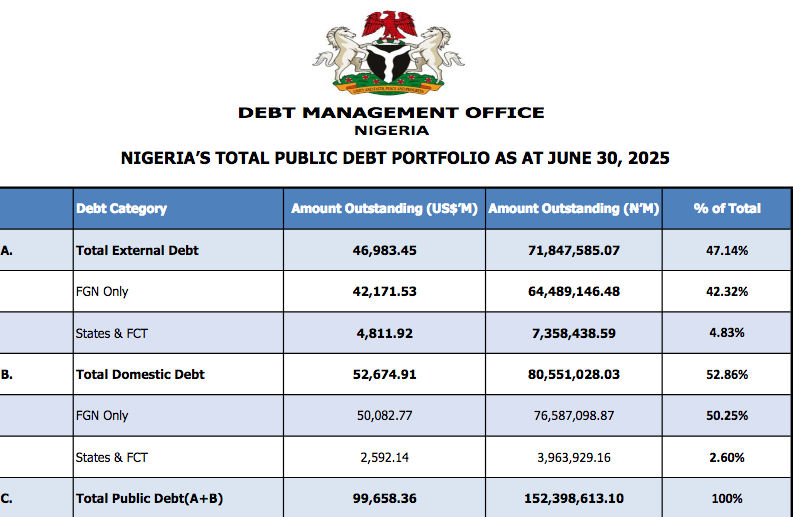

Nigeria’s total public debt climbed to ₦152.40 trillion as of June 30, 2025, up from ₦149.39 trillion at the end of March, according to the latest figures released by the Debt Management Office (DMO). The rise represents a ₦3.01 trillion increase within three months, or 2.01%.

In dollar terms, the debt stock expanded from $97.24 billion to $99.66 billion, an uptick of 2.49%, as both external and domestic obligations inched upward amid a weaker naira and persistent fiscal pressures.

The DMO report revealed that Nigeria’s external debt stood at $46.98 billion (₦71.85 trillion) in June, compared to $45.98 billion (₦70.63 trillion) in March. Multilateral institutions remained the largest creditors, with combined exposure of $23.19 billion, representing 49.4% of total external liabilities. The World Bank, through its International Development Association (IDA) arm, accounted for the biggest share at $18.04 billion.

Bilateral loans totalled $6.20 billion, led by the Export-Import Bank of China with $4.91 billion, followed by smaller exposures to France, Japan, India, and Germany. Commercial borrowings, largely Eurobonds, stood at $17.32 billion, making up 36.9% of external debt, while syndicated and commercial bank loans accounted for $268.9 million.

Analysts say the growing dependence on Eurobonds exposes Nigeria to global financial shocks. “Our external profile shows significant vulnerability to market conditions,” one economist noted, stressing that while multilateral loans offer concessional terms, commercial debt amplifies refinancing risks.

On the domestic front, total obligations hit ₦80.55 trillion by June, an increase of ₦1.79 trillion from ₦78.76 trillion in March. Federal Government bonds dominated the portfolio with ₦60.65 trillion, or 79.2% of total domestic debt. This comprised ₦36.52 trillion in regular naira bonds, ₦22.72 trillion in securitised Ways and Means advances, and ₦1.40 trillion in dollar-denominated bonds.

Treasury bills accounted for ₦12.76 trillion (16.7%), Sukuk instruments for ₦1.29 trillion, while savings bonds, green bonds, and promissory notes stood at ₦91.53 billion, ₦62.36 billion, and ₦1.73 trillion respectively. The DMO noted that some promissory notes included foreign currency-denominated liabilities converted at the June exchange rate.

The continued securitisation of Ways and Means advances, essentially loans from the Central Bank to the Federal Government, reflects deep fiscal strain. The Federal Government’s share of the total debt stood at ₦141.08 trillion, representing 92.6% of the national stock. This comprised ₦64.49 trillion in external debt and ₦76.59 trillion in domestic borrowings.

For the first time this year, the DMO provided a detailed breakdown of state and Federal Capital Territory (FCT) debts. Subnational external obligations were pegged at $4.81 billion (₦7.36 trillion), while domestic debts reached ₦3.96 trillion, bringing their combined total to ₦11.32 trillion, or 7.4% of the country’s debt profile.

The DMO clarified that external debts were converted to naira using the Central Bank’s official exchange rate of ₦1,529.21 per dollar as of June 30, 2025. This depreciation significantly inflated the naira value of foreign loans even without substantial new borrowings.

“This underscores the currency risk inherent in our debt structure,” the DMO explained, noting that weaker exchange rates automatically raise the local currency value of external obligations. “Even when borrowing remains stable, the naira depreciation creates the illusion of higher debt.”

Although Nigeria’s debt-to-GDP ratio remains below global danger thresholds, concerns persist over sustainability. The IMF has repeatedly warned that debt servicing costs are absorbing a disproportionate share of revenues, leaving limited room for capital spending.

Experts argue that the country’s debt trajectory highlights the urgent need for robust fiscal reforms. “Nigeria must enhance revenue mobilisation and cut inefficiencies,” a fiscal analyst said. “Otherwise, debt servicing will keep crowding out essential investment in infrastructure, education, and healthcare.”

With interest payments already consuming over 80% of government revenues, economists say the country must prioritise domestic revenue expansion and expenditure discipline to stabilise its debt path.

As the DMO’s latest figures show, Nigeria’s rising debt profile is not just a function of borrowing—it is also a reflection of a weakening currency, structural revenue shortfalls, and growing reliance on costly debt instruments. Without a firm grip on fiscal consolidation, the burden could deepen, leaving the government with fewer options to finance growth and development.

Leave a comment