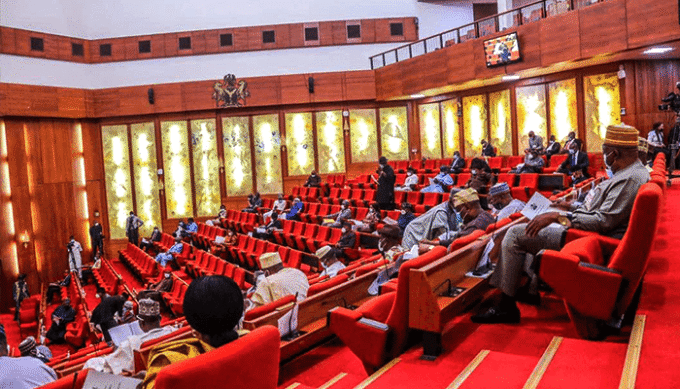

The Federation Account Allocation Committee (FAAC) has shared a total of ₦2.103 trillion among the Federal Government, 36 states, and 774 local government councils as revenue accrued to the federation for September 2025.

The allocation, made at the FAAC meeting held in Abuja on Thursday, represents a ₦710.13 billion drop from the ₦2.838 trillion shared in August 2025.

According to a communiqué issued at the end of the meeting, the ₦2.103 trillion distributable revenue comprised ₦1.239 trillion from statutory revenue, ₦812.59 billion from Value Added Tax (VAT), and ₦51.68 billion from the Electronic Money Transfer Levy (EMTL).

The committee disclosed that the total gross revenue available in September stood at ₦3.054 trillion, from which ₦116.15 billion was deducted for collection costs, while ₦835 billion went to transfers, interventions, refunds, and savings.

Out of the total distributable sum, the Federal Government received ₦711.31 billion, states received ₦727.17 billion, and local governments got ₦529.95 billion.

Additionally, ₦134.96 billion, representing 13 per cent of mineral revenue, was shared among oil-producing states as derivation funds.

From the ₦1.239 trillion statutory revenue, the Federal Government received ₦581.67 billion, states ₦295.03 billion, local councils ₦227.46 billion, and oil-producing states ₦134.96 billion as derivation.

The ₦812.59 billion VAT was distributed as follows: Federal Government (₦121.89 billion), states (₦406.30 billion), and local governments (₦284.41 billion).

Also, from the ₦51.68 billion EMTL, the Federal Government received ₦7.75 billion, states ₦25.84 billion, and local governments ₦18.09 billion.

The communiqué noted a significant increase in Import Duty, VAT, and EMTL collections, while Companies Income Tax (CIT) and Common External Tariff (CET) levies recorded declines.

It added that Petroleum Profit Tax (PPT) rose marginally, while Oil and Gas Royalty and Excise Duty slightly decreased.

Economic observers believe the dip in gross statutory revenue signals a possible slowdown in oil revenue and company profits, while the rise in VAT suggests improved consumption and compliance rates.

The FAAC allocation remains a major source of funding for all tiers of government, supporting recurrent and capital expenditure, especially in states heavily reliant on federal allocations.

Do you want to share a story with us? Do you want to advertise with us? Do you need publicity for a product, service, or event? Contact us on WhatsApp +2348183319097 Email: platformtimes@gmail.com

We are committed to impactful investigative journalism for human interest and social justice. Your donation will help us tell more stories. Kindly donate any amount HERE

Leave a comment