The Association of Securities Dealing Houses of Nigeria has called on the Federal Government to review the recently introduced Capital Gains Tax on securities, following a sharp N6tn decline in market capitalisation in November.

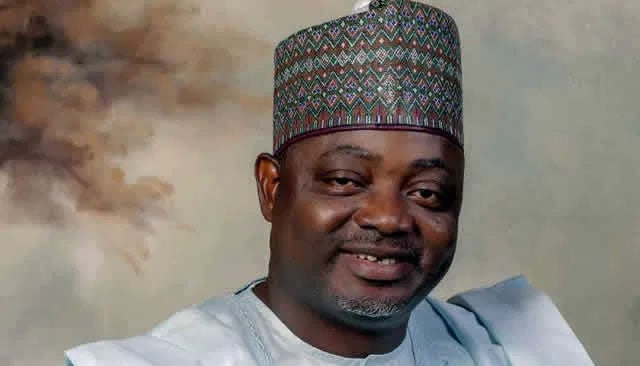

The plea came from ASHON’s newly inaugurated Chairman, Seinde Adenagbe, who was officially decorated as the group’s 6th chairman in Lagos on Friday. Adenagbe warned that the sudden policy change threatens investor confidence and undermines market stability.

“Whatever is true, honest, just, pure, lovely, and of good report should define our conduct. Our word must remain our bond,” Adenagbe said in a statement on Sunday, urging President Bola Tinubu to urgently review the CGT policy. He noted that market capitalisation had climbed to N95tn by October before the sharp decline.

Adenagbe also highlighted that while the Securities and Exchange Commission plans to recapitalise operators, the exercise should strengthen market efficiency rather than eliminate firms through unrealistic capital thresholds. “Capital raising should not lead to the demise of promoters but guarantee the survival of firms, employees, and the broader ecosystem,” he added.

The new chairman outlined a 10-point agenda aimed at reinforcing professionalism, ethics, and governance across the Nigerian capital market, including improved investor education, technology adoption, and unified advocacy among market operators.

Immediate past Chairman Sam Onukwue pledged support to the new administration, citing achievements such as the Digital Transformation Programme and contributions to the 2025 Investment and Securities Act.

The inauguration ceremony also drew top capital market stakeholders, including executives from the Nigerian Exchange Limited, NGX Regulation, the Investment and Securities Tribunal, the Chartered Institute of Stockbrokers, NASD Plc, and the Lagos Commodities and Futures Exchange.

Leave a comment