By Chukwuma Umeorah

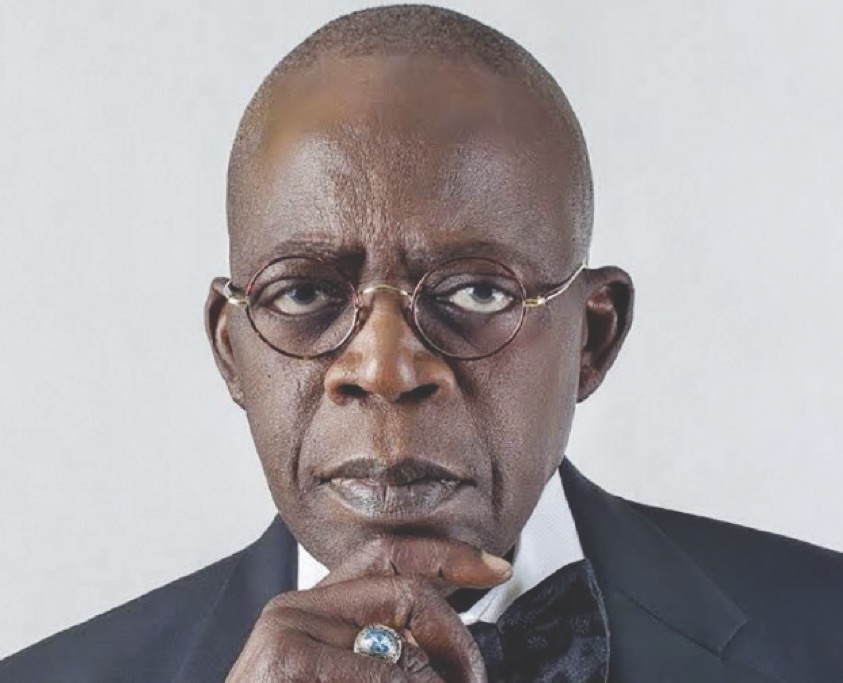

Unlike other parts of the economy, players in the Nigerian capital market are lauding the President Bola Tinubu administration, saying bold reforms it undertook since inauguration on May 29, 2023, has breathed new life into the system.

They said the reforms have ignited investor confidence, attracted fresh inflows and positioned the market as a critical engine for national economic transformation.

Central to these reforms are the removal of fuel subsidies, floatation of the naira and most recently, the enactment of the Investment and Securities Act (ISA) 2025, each significantly impacting Nigeria’s capital market.

Over the past two years, these measures have spurred remarkable growth in the Nigerian Exchange (NGX) All-Share Index (ASI), which jumped from 51,251.06 in 2022 to 109,028.62 by May 2025 representing a 112.7 per cent increase. However, this progress has not been without consequences, as the broader population continues to grapple with inflation, currency volatility, and a worsening cost-of-living crisis.

The reforms, while widely acknowledged as necessary for long-term economic stability, introduced immediate hardships. The abrupt withdrawal of fuel subsidies in June 2023 triggered a 200 per cent spike in petrol prices, pushing inflation to a 28-year high of 28.9 per cent by December 2023 and further to 34.8 per cent in early 2025. Food inflation, which climbed to 33.9 per cent by the end of 2023, worsened the cost-of-living crisis, eroding purchasing power and discouraging retail investor participation. Despite a January recalibration of inflation metrics by the Nigerian Bureau of Statistics (NBS) which brought the headline figure down to 24.48 per cent, skepticism persists over its accuracy especially given the grim economic reality on the average Nigerian.

The floatation of the naira, aimed at unifying exchange rates and attracting foreign investment, caused steep devaluation. From N1,000/$1 in late 2023, the naira plummeted further to N1,600/$1 by mid-2024. This instability made it difficult for foreign portfolio investors to repatriate funds, resulting in a drop in foreign equity participation from 17 per cent in 2022 to 11 per cent in 2023, the lowest in over a decade. According to the NGX’s Domestic and Foreign Portfolio Investment report, foreign transactions declined by 90.99 per cent in April 2025, down to N63.07 billion from N699.89 billion recorded in March.

The Central Bank of Nigeria’s (CBN) tight monetary stance, with benchmark interest rates raised to 27.5 per cent pushed up borrowing costs for businesses, squeezing corporate profits and dampening stock valuations.

The Chief Executive Officer of Arthur Stevens Asset Management Limited, Olatunde Amolegbe, observed that the “The floating of the naira and removal of subsidies, while necessary, caused significant disruptions. Companies faced higher operational costs, and investors grappled with uncertainty, especially in the early months of the reforms.”

“Although these reforms were very necessary especially if we look critically at where we are coming from as a country. Its clear the economy was on life support and on the brink of collapse before he came in.”

Underlying structural issues also remain. Persistently low retail investor participation, tied to weak disposable incomes, limits market depth. With Nigeria’s poverty rate at 38.9 per cent in 2023 translating to 87 million people living below the poverty line, analysts say capital market gains have yet to trickle down to the everyday Nigerian.

Amolegbe added, “Efforts to reduce operational and financial costs for companies must be prioritized to boost production and create jobs. Challenges around electricity supply and security, which impact food production and business efficiency, must be addressed. While the reforms are essential, they have caused significant pain, and the government must cushion this burden as we work towards long-term economic goals.”

Nonetheless, the reforms have significantly boosted capital market performance. The NGX ASI surged by 45.4 per cent in 2023, closing at 74,502.58, and continued its rally into 2025, hitting 109,028.62 by May, a cumulative gain of over 112 per cent since Tinubu assumed office.

ISA 2025

Signed into law on March 29, 2025, the Investment and Securities Act (ISA) 2025 is hailed by stakeholders as the most transformative capital market policy in nearly two decades. Repealing the 2007 Act, ISA 2025 introduces wide-ranging reforms designed to modernize Nigeria’s market and align it with global standards.

Key provisions include enhanced regulatory oversight, expanded powers for the Securities and Exchange Commission (SEC) to regulate digital assets, including cryptocurrencies and bringing virtual asset service providers under SEC’s purview. The Act also distinguishes between composite exchanges (trading all securities) and non-composite exchanges (limited to specific asset classes), aimed at improving market clarity and efficiency.

Provisions on systemic risk management have strengthened the SEC’s ability to monitor and mitigate risks, while insolvency exemptions for financial market infrastructures now protect critical transactions during periods of financial distress.

SEC Director General, Emomotimi Agama, described the ISA 2025 as “a transformative step for building a dynamic, inclusive, and resilient capital market,” noting that it positions Nigeria for “Signatory A” status with the International Organization of Securities Commissions (IOSCO), potentially attracting 15–20 per cent more foreign investment.

The CBN’s banking recapitalization programme, launched in 2024, has also injected new life into the market. Leading banks such as Zenith and GTCO raised billions through rights issues and public offerings, boosting liquidity and investor confidence. “The recapitalization exercise has been a game-changer,” said Amolegbe.

He also noted a resurgence in the fixed-income market: “The government issued its first domestic US dollar bond and returned to the Eurobond market after a decade, raising critical funds for infrastructure and budgetary needs.”

David Adonri, Chairman at Highcap Securities, stated, “Debt capital raising by public and corporate issuers assumed unprecedented dimensions, akin to a candle burning from both ends.” With high Eurobond yields limiting international borrowing, domestic bonds became central to bridging Nigeria’s fiscal gaps.

Giving an in-depth view on Tinubu’s performance, Adonri added, “The Capital Market consists of two segments. These are the Primary Market where fund users called Issuers raise capital to finance their activities and the Secondary Market which serves as an investment outlet for investors. President Tinubu’s two years in office has positively impacted these market segments considerably. For the past two years, capital raising activities have escalated to levels only witnessed before the Global Meltdown in 2008.”

“The mandatory recapitalization exercise of banks formed the bulk of transactions in the Primary Market while several public companies that were wounded by the floating of the Naira also approached the Primary Market to refinance their liabilities. The Primary Market in these two years is akin to a candle that is burning from both ends. While capital raising through equities has been intensely increasing, debt capital raising by public and corporate Issuers also assumed unprecedented dimensions,” Adonri explained.

According to both experts, ISA 2025 and the recapitalization drive have created a more liquid, transparent capital market that appeals to institutional and foreign investors. Adonri while highlighting areas for improvement added that “the Capital Market has enjoyed a big boom in two years of President Tinubu’s leadership.”

New listings bolster market capitalisation

The period under review also witnessed significant listings on the NGX, further enhancing market capitalization and investor confidence.

In 2024, the Exchange recorded approximately N12.17 trillion in new listings, comprising both Federal Government of Nigeria (FGN) bonds and corporate securities. Notably, corporate listings accounted for N6.2 trillion, while FGN bonds contributed N5.95 trillion .

Among the prominent corporate listings, Transcorp Power Plc made a significant impact in March 2024 by listing 7.5 billion ordinary shares at N240.00 per share, adding N1.8 trillion to the market. In October 2024, Aradel Holdings Plc debuted on the NGX with a record-breaking N3.4 trillion listing, making it the largest single addition to the market that year . Haldane McCall Plc also joined the Exchange in November 2024, listing 3.12 billion shares at N3.84, contributing N11.99 billion to the market .

These listings not only enhanced market liquidity but also demonstrated the Exchange’s ability to attract a broad spectrum of participants from diverse sectors of the economy.

Opportunities and headwinds

Stakeholders believe Nigeria’s capital market is primed for continued growth, dependent on consistent policy execution and the resolution of macroeconomic constraints. ISA 2025’s focus on digital assets and commodity exchanges is expected to drive innovation and broaden investor participation.

Akin Akeredolu-Ale, Managing Director of Lagos Commodities and Futures Exchange (LCFE), lauded the Act’s provisions on commodities regulation. “It creates more space for governance now. It creates more space for a regulatory framework to function better, for investors to have more confidence in the capital market ecosystem,” he said at the law’s unveiling.

Experts also noted that SEC’s move to license crypto exchanges such as Busha and Quidax signals early progress toward making Nigeria a regional fintech hub.

Additionally, the establishment of a commodities exchange framework, particularly the introduction of warehouse receipts, is expected to boost agricultural financing and improve price discovery, potentially paving the way for more agribusiness listings on the NGX. Still, these experts noted that economic stability remains the bedrock for sustainable growth.

Leave a comment