…Oil prices spike, inflation to follow –Experts

…Outline how Nigeria can minimise impact, maximise opportunity

By Uche Usim

Fresh tensions in the Middle East, orchestrated by the ongoing survivalist conflict between Israel and Iran, are sending shockwaves through global energy markets.

Already, oil prices are surging at the fastest pace in three years and the ripple effects are threatening supply chains and inflation rates worldwide.

The region, home to the world’s most vital oil producers and shipping routes, has seen flare-ups that are rattling investors and disrupting maritime logistics.

At the weekend, Brent Crude, Nigeria’s benchmark, peaked intra-day around $78.50/barrel (14 per cent climb), while West Texas Intermediate (WTI), US benchmark, soared to around $77/barrel, driven by fears of supply constraints in the face of mounting instability.

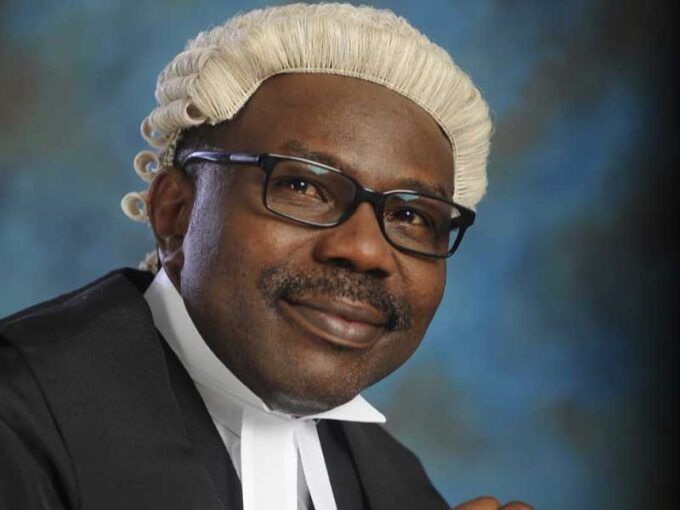

On how Nigeria can leverage the crisis to fortify the economy while remaining insulated from its scathing impacts, the Director General, Centre for the Promotion of Public Enterprise (CPPE), Dr Muda Yusuf charged the federal government to urgently ramp up crude oil production since the crisis has triggered a price surge.

“High crude oil prices remain positive for our economy because we’ll generate more FX revenue. It’ll help out exchange rates and all that. So, from that perspective, the crisis is beneficial. We’re producing less than the OPEC quota and we should do more.

“Again, investors in upstream will live at higher crude prices which is good for return on investment.

So, the government should look into this as it helps our fiscal side.

“However, the downside is that energy prices will spike. Jet fuel, gas, petrol, diesel etc will experience a price hike. This will erode the profit margin of many businesses. Again, it will swell the cost of transportation. If the war continues, it’ll affect the global economy and growth.

“War creates instability. Flights are already disrupted, many air spaces have been closed.

“We should brace up to adjust for the consequences. High energy prices may cause inflationary pressures. It’ll swell the cost of operations. We can adjust our fiscal assumptions to be more realistic”, he told Daily Sun.

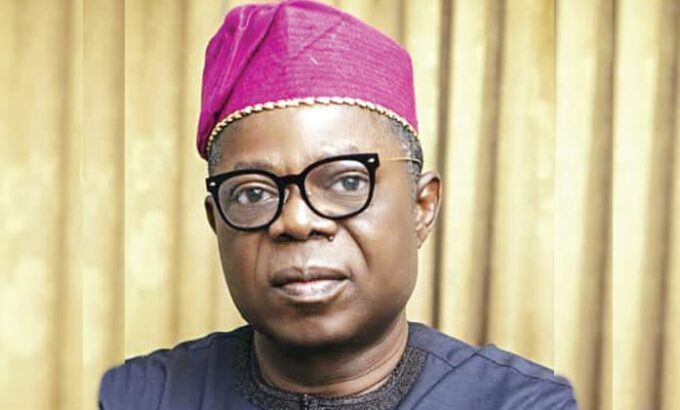

In a WhatsApp message to Daily Sun, Dr. Paul Alaje, Chief Economist and Partner at SPM Professionals, emphasised the need for the government at national and sub-national levels and other influential people to preach and love so the country maintains stability which is foundational to engendering socio-economic growth.

“This is the time to show love and unity more than ever before. We’re polarised along ethnic, religious and regional lines. The world has gone through a lot of troubles for years. “We need to deliberately preach peace and demonstrate it”, he said.

Nigeria’s petrol imports stood at N1.76 trillion in Q1 2025, according to the National Bureau of Statistics (NBS).

So, the surge in global crude oil prices has raised concerns about the ripple effects on Nigeria’s already inflation-prone economy.

In a deregulated environment, rising international oil prices often translate into higher domestic fuel prices, tightening the financial burden on households and businesses alike.

Jide Pratt, Country Manager of TradeGrid and Chief Operating Officer of Aiona, emphasised the nexus between Middle Eastern instability and fuel prices in Nigeria.

“Iran, being a major oil-producing nation, is a trigger for the prices of crude oil,” Pratt explained. “As such, with the bombing, the immediate effect we see is that prices of Brent have gone up to $78 and now about $73 as an immediate reaction.”

He added that, should tensions escalate further, the consequences could be even more severe.

“If this escalates, then the prices will go up and so will the prices of distillates here in Nigeria and across the world.”

Pratt also pointed out that Nigeria’s volatile foreign exchange rate could worsen the domestic impact. “What makes it worse will be if we do not keep our exchange rate consistent and constant,” he said.

“While the oil price spike may bring increased revenue to the Nigerian government, analysts stress the need for prudent financial management.

“In all, more revenue for the Federal Government and states, if they spend it in a frugal way,” Pratt noted.

As the primary artery for global energy flows and maritime trade, the Middle East’s shipping lanes are increasingly vulnerable. Attacks by Houthi rebels on cargo vessels traversing the Red Sea and Suez Canal, routes that connect Asia to Europe, have added new layers of risk. These disruptions are pushing shipping insurance premiums higher, a cost that inevitably lands on the consumer’s shoulders.

“This has forced many ships to go the long way around Africa on routes between Asia and Europe, which adds one to two weeks of travel time and around $1 million in cost per journey,” said Sarah Schiffling, an academic at the Hanken School of Economics. “Longer travel times also mean that global capacity is reduced as ships are tied up on a journey for longer, and that all has ripple effects across global transport networks and supply chains.”

Oil’s influence, however, extends far beyond the pump. It is a key input in the production of goods ranging from plastic toys to jet fuel, meaning even a modest price hike reverberates across economies. According to the International Monetary Fund (IMF), a 10% increase in oil prices typically drives inflation in advanced economies up by around 0.4 percentage points.

Further compounding the risks is the looming threat from Iran, which has repeatedly hinted at blocking the Strait of Hormuz, a narrow but crucial chokepoint linking the Persian Gulf to the Arabian Sea. A staggering 25% of the world’s oil trade passes through the strait.

Analysts at Goldman Sachs warn that any blockade could propel oil prices past $100 per barrel.

Still, such a drastic move could carry diplomatic costs. “That would be an extreme step for Iran,” analysts note, “one that would likely provoke backlash from China, Tehran’s top buyer, as well as other regional oil powers like Qatar and the UAE, who also depend on the strait for exports.”

For now, some experts remain cautiously optimistic about trade resilience.

But the escalating risks highlight a familiar truth that when the Middle East stirs, the world economy feels the tremors.

Leave a comment