From Adanna Nnamani, Abuja

The federal government spent a whopping N611.71 billion in March 2025 to service its first-ever dollar-denominated bond issued within the local market, reflecting the growing strain of foreign exchange-linked debt on the economy.

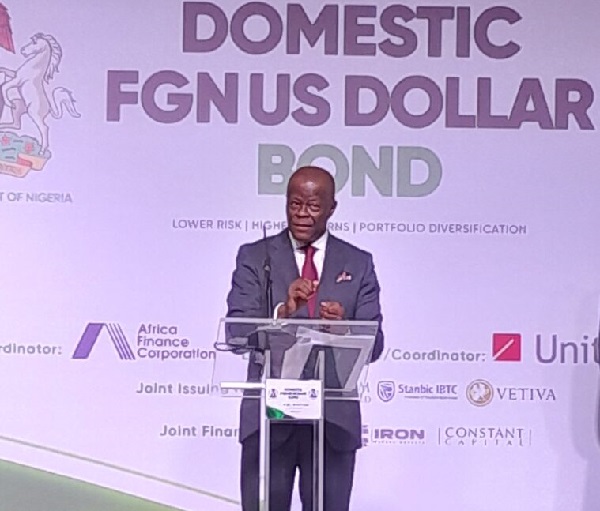

The bond, introduced in August 2024, was part of a $2 billion domestic programme designed to attract dollar liquidity from local investors. It raised over $900 million and was 180 per cent oversubscribed, making it the first of its kind to be issued in foreign currency but sourced locally. It was later listed on the Nigerian Exchange and FMDQ platforms and won the “West Africa Deal of the Year”.

Figures from the Debt Management Office (DMO) show that the March payment accounted for 47 per cent of the N1.3 trillion spent on domestic debt servicing in the month and nearly a quarter of the total N2.61 trillion spent in Q1 2025 alone.

Although the interest due in March was $44.97 million, roughly N67.99 billion when converted at the official exchange rate of N1,511.80/$, the final bill stood at N611.71 billion. This suggests a partial principal repayment of over N543 billion may have occurred barely seven months after the bond’s issuance.

By the end of March, the outstanding value of the bond had dropped from N1.47 trillion in September 2024 to N1.41 trillion, now representing 1.88 per cent of Nigeria’s total domestic debt stock of N74.89 trillion.

While the bond was praised for boosting local capital market activity and avoiding the risks of international borrowing, its dollar denomination has raised red flags. With the naira trading above N1,500/$, the cost of repaying the debt has ballooned in local currency terms, making the instrument one of the costliest on Nigeria’s books.

The March servicing cost for the dollar bond alone exceeded interest payments on all other domestic debt instruments combined for the month, raising concern over Nigeria’s rising exposure to FX-linked liabilities, even when such borrowings are made at home.

Analysts say the initiative, though innovative, has added weight to Nigeria’s fiscal burden at a time when the country is grappling with currency instability and mounting debt obligations.

Leave a comment