•Experts offer advisory on implementation

•Say it will favour small business owners

By Adanna Nnamani, Okwe Obi (Abuja), Ngozi Nwoke (Lagos)

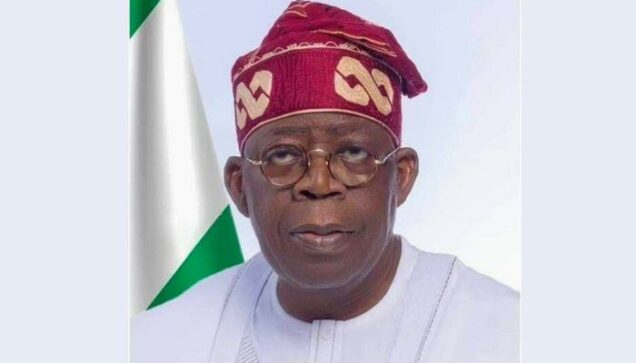

Some economic experts have endorsed the new tax reform bills recently signed into law by President Bola Tinubu, describing them as reforms that will be beneficial to Nigerians and small business owners.

The four new laws that will take effect in January 2026 are the Nigeria Tax (Fair Taxation), Nigeria Tax Administration Law, Nigeria Revenue Service (Establishment) law and Joint Revenue Board (Establishment) law.

Government should amend the legislation when necessary

Muda Yusuf, CEO, Centre for the Promotion of Private Enterprises, has described the new set of tax laws as another significant policy transition which deserves to be supported.

Yusuf, who is also a former director general, Lagos Chamber of Commerce and Industry, added that the new tax laws have a strong value proposition as a major step towards resetting the tax administration in the country.

Some of the immediate and expected outcomes and impact on Nigerians, he said, include the abrogation of archaic tax laws which are out of tune with current economic realities; improvement in tax administration leveraging more on technology; streamlining the number of taxes and multiple levies; enhancement of revenue performance and boosting fiscal consolidation.

“Better revenue outcomes would hopefully improve government capacity to fund infrastructure and improve productivity of economic players. Improved revenue outcomes should also result in fiscal deficit reduction and strengthening of macroeconomic stability as well as expanded concessions to small businesses and low income earners. However, we should realise that no reform or legislation is perfect.

“The government should be humble enough to tweak the legislation if and when necessary, without compromising the fundamentals of the tax reform. The reality is that reform is a journey, not a destination, which is why reviews may be necessary in the light of experience.

“Over the six months transition period, there should be a robust framework for a seamless implementation of the laws. The implementation consultative processes should be very comprehensive to avoid disruptions to the fiscal operations of the government.”

He noted that implementation of the new tax laws in the informal sector could pose a serious challenge given the poor record keeping culture and literacy level.

“This sector accounts for about 40 percent of our GDP and 50 percent of jobs. There is also the risk of high political cost of enforcement of the laws in the informal sector and among small businesses. Enforcement in this space requires a great deal of creativity and pragmatism.”

While pointing out that low income earners have been exempted from taxes to a certain limit, just as small businesses will now enjoy a certain degree of exemption, Yusuf expressed concern over the implementation process, stressing that since the Nigerian Revenue Service is going to leverage on technology, it should be mindful of the fact that inflow into the bank account of a small business may not necessarily mean that the business is doing well.

A relief for Nigerians, challenge to states

An economic and development expert, Dr. Aliyu Ilias, has said that the laws would ease the tax burden on Nigerians who earn lower wages and allow small businesses to thrive.

Ilias explained that workers in lower civil service cadres, such as those in local governments at grade levels three and four would either pay significantly reduced taxes or be exempt entirely.

This, according to him, means more money in their pockets at a time when inflation has battered household incomes.

He added that businesses generating less than N25 million annually and in some cases even up to N50 million, would be exempt from certain taxes, including Value Added Tax (VAT). This, he said, will create room for expansion and improve their capacity to hire more workers.

Ilias, however, warned that while individuals and businesses may benefit, states could suffer revenue losses due to the shrinking taxable income base, especially from Pay As You Earn (PAYE) collections.

“Most states have a larger share of low-income workers. With the new law, workers earning N70,000 and below will not be taxed. Since many civil servants fall into this bracket, states may experience a shortfall in PAYE collections,” he added.

Good for economy and Nigerians

Dr. Chijioke Ekechukwu, CEO of Dignity Finance, and a former Director-General of the Abuja Chamber of Commerce and Industry (ACCI), described the tax reforms as long overdue.

According to him, despite initial skepticism, a closer look at the details reveals that the new laws are good for both the economy and the average Nigerian.

Ekechukwu said that from January 2026, more Nigerians will enjoy a form of tax holiday, as those whose incomes fall below the threshold will no longer be taxed.

He applauded the decision of the National Assembly to reject a proposed increase in VAT, saying such a move would have further strained citizens who are already grappling with harsh economic realities. The economist also noted that the government needs to use technology more effectively to track and tax online and digital businesses which mostly operate without paying taxes.

“Even though the reforms were initially received with mixed feelings, those of us who studied the details found it encouraging,” he said.

“We are not collecting enough from e-commerce, virtual businesses, and other online transactions. If we deploy technology effectively, we can tap into this sector and improve tax collection,” he added.

New tax laws favours the poor

A former President of the Chartered Institute of Taxation of Nigeria (CITN), Adedayo Adesina, explained that the new tax laws would help small business owners and low income earners.

Adesina said: “It is a tax that favors the poor. Beyond that, it is a policy-based act in the sense that the policy is now so consistent with each other that people can now plan without too much complication in the wording of the law.

“And you can know where to go to in order to actually know what the law says. There are three dimensions to actually putting this issue in perspective. You look at the policy, you look at the administration. And you look at the law – just three things.

“Before now, we were not very consistent in terms of policy direction, and in terms of the law being too wordy and ambiguous. The administration was going through a lot of synergy, trying to make sure that it aligns with the wishes of Nigeria. I think that is now being addressed. And because it is being addressed, the issue of implementation should now be the area we should focus on because the law is still a paper work.

“Until its implementation begins before we start seeing the impact on the people. But it is a very good law and it is a step in the right direction.”

Adesina explained that the reason for the change of the name of the tax authority from the Federal Inland Revenue Service to the Nigeria Revenue Service is that there was a misconception as some people had the feeling that the agency was only meant for federal taxes.

“Now that it has been changed to Nigerian Revenue Service, all those things are held up at the appropriation accounts and all the other areas in terms of allocation and appropriation.

“So, when you are talking about what comes into the cooking pot, it will be handled by the Nigerian Revenue Service. The name change was strategic and deliberate to let people realise that this is not dealing with only federal; it is dealing with federation.

Concerns over implementation

Jide Ojo, a public affairs analyst, while noting that the change of name would not affect revenue collection, expressed concern over the implementation of the Act, stating that the country has never had shortage of laws and policies.

“There are a number of tax reform laws. First, let us look at it from the perspective that the government will have more money to be able to deliver on infrastructural development because more people will be brought into the tax net. So the current low tax-to-GDP ratio will be a thing of the past. Low-income earners have been exempted from payment of income tax.

“So, if you are hanging below a certain threshold, like those who are on minimum wage of N70,000, you are exempted from paying tax. So that is what is called tax justice.

“In the past, they used to say, tax payers money. People were not paying taxes, but we were enjoying the largesse of crude oil.

“Now, when people pay tax, they would demand accountability, they would demand good governance. It would spur them to put it to good use because people are keeping their eyes on what the money is used for.

“There is an ombudsman that is settled by this law. There are no fees of either over taxation or improper computation of taxes. So there will be this ombudsman that will be set up to resolve issues around tax disputes.

“Then you also look at the fact that small businesses, micro, small and medium, particularly micro and small businesses. If your total capital is below a certain threshold, I think N50 million, it is exempted from payment of tax. That is tax on your revenue.

“In the past, we had business owners paying multiple taxes, tariffs, and levies. But now it has been brought down. All those multiple taxation issues have been resolved to the advantage of the ordinary citizens.

“Local governments collecting, state collecting, the federal collecting, now it is going to be harmonized. You are going to be paying just a few taxes. Everything is now consolidated.

“So those are the major benefits. And then the fact that they did not increase the value added tax.

“You know, there is no increase in the tax. It is 7.5 that we are currently paying. And then another advantage is that food items, health care, education, and about five different things have been exempted from value added tax. House rent, food, health care, water bills, education, drugs, there will be no payment of value added tax on those.

“But the big elephant is in the implementation, because we have never been short of laws. Implementation will be seamless and that there will be public enlightenment by the National Orientation Agency, states and Federal Ministry of Information and National Orientation, as well as the media will take it up.

“So we need public education, particularly on areas that are naughty. For instance, I still believe that we need to know what will happen to those bylaws that have been made by local governments, and the fact that the constitution has assigned certain areas for them to, like issue of illegal licensing, management of abattoirs, cemeteries and all of that, where they can make money and the running the local governments.

“Those bylaws, how do you review them to be in sync with the federal laws? Because these are part of what business owners have been complaining that there is multiple taxation.

“So, I want to believe that there will be a need to review both state tax laws and the local government bylaws to be in sync with these new tax laws.

“There is six-month moratorium and of course, even for workers, whether private or public workers, if you are paving a certain threshold of salaries, even though you are not totally exempted from payment of taxes, there is a likelihood that you will pay less than what you are currently paying as a PAYE.”

Leave a comment