In an era where organisations are redefining leadership and equity, MTN Nigeria continues to set the pace with its growing cadre of women in senior leadership positions. The company’s consistent recognition of female excellence, both within and beyond its walls, reflects a deep, deliberate culture of inclusion and empowerment.

Most recently, Esther Akinnukawe, Chief Human Resources Officer at MTN Nigeria, was conferred with the Fellowship Award of the Chartered Institute of Personnel Management (CIPM) at the CIPM Gala Night and Awards Ceremony held on Thursday, October 30th, 2025.

“This recognition is truly fulfilling, it represents the culmination of years of passion and perseverance. To be honoured by the leading institute for HR professionals in Nigeria is a remarkable achievement. I look forward to applying my experience and insight to continue strengthening MTN’s people strategy and driving excellence in human resource management,” Akinnukawe said following the honour.

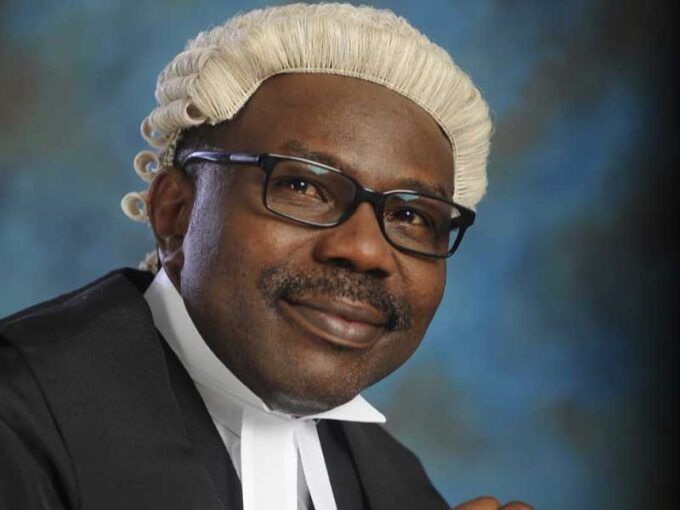

Her recognition adds to a growing list of milestones achieved by MTN Nigeria’s female leaders in recent years. In July 2025, Uto Ukpanah, the company’s Company Secretary, made history as the 30th President and Chairman of the Institute of Chartered Secretaries and Administrators of Nigeria (ICSAN), becoming only the second woman to hold the role in nearly six decades. According to the company’s 2024 Annual Report, women now represent 41.4% of the total workforce, 34.7% of management, and 21.4% of the board. These figures reflect a steady rise in gender representation across all levels, supported by a range of internal programmes focused on inclusion, mentorship, and leadership development.

In the first half of 2025, MTN Nigeria’s strong financial and operational performance further reinforced the strength of its diverse leadership. The company recorded a 54.6% increase in service revenue to ₦2.4 trillion and an impressive EBITDA growth of 119.5%, reflecting its resilience, innovation, and effective people strategy .

This performance culture, anchored on inclusion and excellence, is reflected across the company’s leadership team. Beyond Ukpanah and Akinnukawe, several women occupy influential positions shaping the company’s vision and social impact. They include Dr. Mosun Belo-Olusoga, Chairman of the MTN Foundation; Odunayo Sanya, Executive Director of the MTN Foundation and recipient of the 2024 CSI Personality of the Year Award at the Nigeria Tech Innovation & Telecoms Awards; A’isha Mumuni, Chief Digital Officer; Oby Ugboma, Chief Risk & Compliance Officer; Lynda Saint-Nwafor, Chief Enterprise Business Officer; Ugonwa Nwoye, Chief Customer Relations and Experience Officer; and Onyinye Ikenna-Emeka, Chief Marketing Officer.

Her journey, from teaching and consulting to leading human capital strategy for Africa’s leading TechCo brand, exemplifies MTN’s belief that empowered women empower organisations.

MTN’s ongoing success story, both in its financial results and in people development, demonstrates that diversity is not just a metric, it’s a growth strategy. As the company continues to invest in digital skills, entrepreneurship, and social impact programmes, its commitment to elevating women into positions of influence remains resolute.

Leave a comment