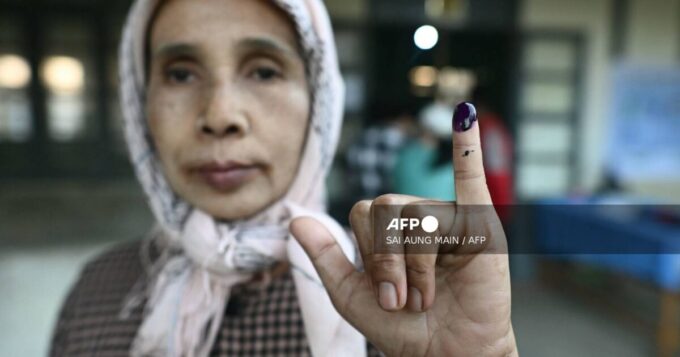

The Peoples Democratic Party has declared that its national convention scheduled for Saturday in Ibadan will proceed as planned, insisting that the exercise is “sacrosanct” despite a subsisting court order seeking to halt it.

Chairman of the 2025 National Convention Organising Committee and Adamawa State Governor, Ahmadu Umaru Fintiri, made the declaration on Friday after a high-level stakeholders’ meeting held at the Bauchi Governor’s Lodge, Asokoro, Abuja.

Fintiri, who briefed journalists at the end of the meeting, said the party had resolved to go ahead with preparations, stressing that no legal distractions would stop the convention.

“We’ve just come out of our critical stakeholders’ meeting where far-reaching decisions were taken. I want to tell you that we are going to Ibadan for our convention, and the convention is sacrosanct,” he said.

The meeting drew key leaders of the party, including members of the PDP Governors’ Forum, the National Working Committee and the Board of Trustees.

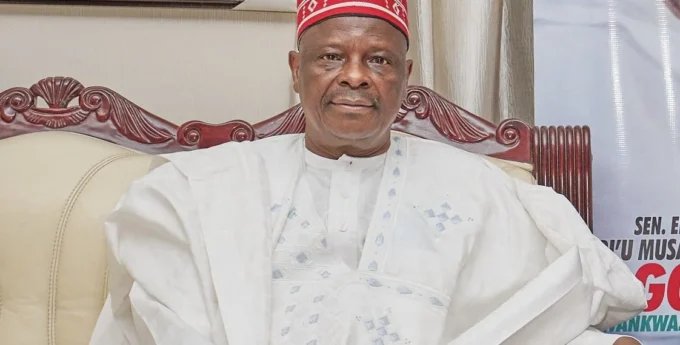

Those in attendance included Governors Bala Mohammed and Seyi Makinde, acting national chairman Umar Damagum, national publicity secretary Debo Ologunagba, and former Senate President Bukola Saraki.

Also present were former minister Tanimu Turaki — widely endorsed as the consensus candidate for national chairman — Senator Natasha Akpoti-Uduaghan, and the chairman of the PDP South-South Caretaker Committee, Emmanuel Ogidi.

The declaration comes amid rising tension over a court order restraining the Independent National Electoral Commission (INEC) from monitoring the exercise until the party offers former governor Sule Lamido a nomination form for the national chairmanship contest.

Despite the legal controversy, PDP leaders on Friday maintained that the convention would go on, setting the stage for what could become a major political showdown.

Do you want to share a story with us? Do you want to advertise with us? Do you need publicity for a product, service, or event? Contact us on WhatsApp +2348183319097 Email: platformtimes@gmail.com

We are committed to impactful investigative journalism for human interest and social justice. Your donation will help us tell more stories. Kindly donate any amount HERE

Leave a comment