By Chukwuma Umeorah

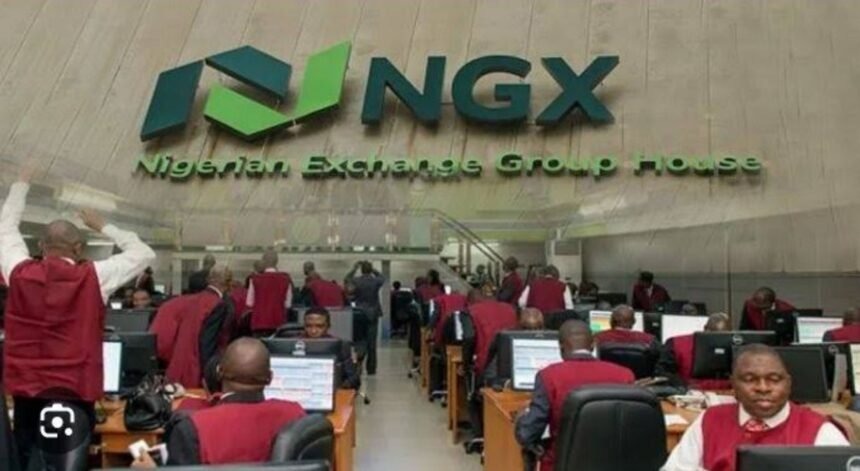

The Nigerian Exchange (NGX) closed the week ended August 15, 2025, in the red as the equities market lost N713 billion in value, with investors reacting to weaker sentiment and broad-based selloffs across major sectors. The All-Share Index fell 0.77 per cent week-on-week to settle at 144,628.20 points, while market capitalisation dipped to N91.50 trillion, trimming year-to-date return to 40.52 per cent.

The downturn was driven largely by declines in the Banking, Consumer Goods, Industrial Goods, Oil & Gas, and Commodities sectors. In contrast, the Insurance Index stood out, surging 8.21 per cent on renewed optimism following the signing of the Nigerian Insurance Act into law. Other indices that advanced included NGX AFR Dividend Yield which rose 1.57 per cent and NGX Growth Index, up by 9.50 per cent.

Market activity slowed, with a total turnover of 8.56 billion shares worth N99.94 billion traded in 177,870 deals, compared with 8.73 billion shares valued at N134.58 billion exchanged in the previous week across 180,290 deals. The Financial Services sector dominated trading, accounting for 80.75 per cent of total volume and 56.75 per cent of value, followed by Oil & Gas and Agriculture industries.

Universal Insurance, Linkage Assurance, and AIICO Insurance were the top three traded equities by volume, contributing 32.54 per cent of the total turnover.

The week also recorded mixed price movements. Fifty equities appreciated, lower than 66 in the prior week, while 49 declined compared to 41 previously. Top gainers included Mutual Benefits Assurance (+31.85 per cent), Triple Gee (+30.23 per cent), and SUNU Assurance (+23.80 per cent). On the other hand, UPDC declined by 17.72 per cent, LivingTrust Mortgage Bank (-16.00 per cent), and Berger Paints (-14.67 percent) leading the losers’ chart.

In the fixed income market, bond turnover rose to 102,338 units valued at N101.28 million, up from 85,480 units worth N79.36 million the prior week. Exchange Traded Products (ETPs), however, declined sharply, with 216,055 units valued at N27.02 million traded versus 948,445 units worth N43.77 million previously.

Cowry Asset analysts noted that “weak sentiments will persist in the equities market as investors continue to balance profit-taking activities with selective bargain hunting.” They added that “ongoing portfolio reshuffling and sector rotation will likely define market dynamics in the near term”.

Meanwhile, the macroeconomic backdrop provided a mixed picture. Nigeria’s headline inflation eased for the fourth consecutive month to 21.88 per cent in July, supported by naira stability, improved FX liquidity, and softer global commodity prices. Cowry expects “intermittent pullbacks to provide opportunities for investors who may leverage price corrections and maintain a strategic focus on value-driven opportunities, while keeping an eye on macroeconomic developments that could influence sentiment.”

Leave a comment