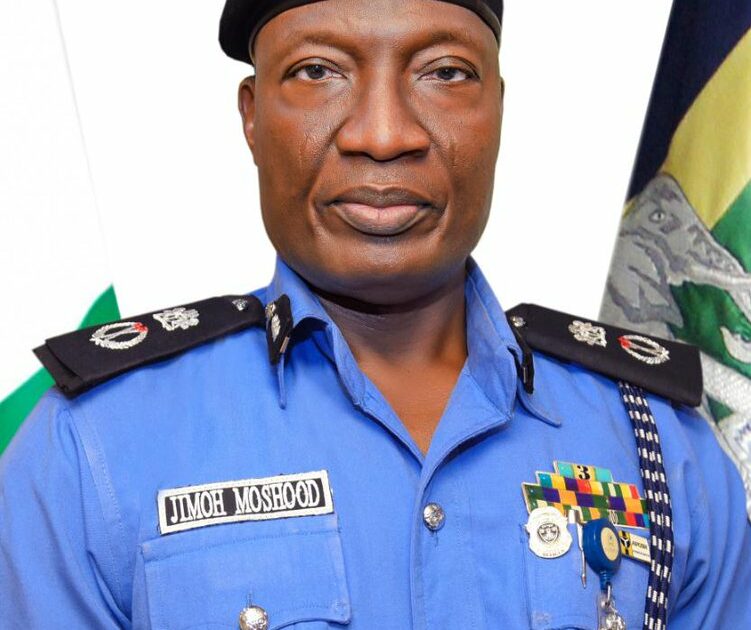

The Commissioner of Police, Lagos State Command, Mr Olohundare Jimoh, has announced the successful discovery and shutdown of a large-scale fake drug manufacturing site in Ojo area of the state.

Speaking with newsmen on Wednesday at the raided building on Alhaji Oki Road, Mosafejo, in Ojo, Jimoh described the operation as a significant breakthrough in safeguarding public health.

He said that the illegal facility had been producing counterfeit pharmaceutical products intended for public consumption.

He said that many of the items recovered were orally administered drugs that posed serious health risks to unsuspecting buyers.

“Fake drugs injure and endanger the lives of thousands. The last floor of the three-storey building was where these items were being produced illegally.

“The machines used to alter drug expiry dates and repackage expired products were also recovered,” he said.

CP Jimoh stated that the operation was conducted in accordance with the powers granted to the police under Nigerian law, which mandates officers to investigate and arrest individuals involved in the production and distribution of counterfeit drugs.

He said that the police collaborated with relevant agencies throughout the investigation.

According to him, the alleged mastermind behind the operation is still on the run, and efforts are underway to track him down.

“We will extend our investigation to all his activities, we are not going to limit our work to this building, our collaboration with relevant agencies will continue until every person involved is brought to justice,” he said.

The police boss issued a stern warning, urging the public to exercise caution when buying medicines and to verify the authenticity of drugs before use.

He noted that counterfeiters often target unsuspecting buyers and encouraged people to report any suspicious activities.

“Consumers must be very careful about where they buy their drugs. If you have doubts, verify before you buy,” he said.

The commissioner also commended officers of the command, community leaders, and members of the public whose credible intelligence led to the raid.

“We appreciate the valuable information from the community. Once you give information to the police, we will protect you. This success came from actionable intelligence, and we want the public to have confidence in us,” he said.

He reiterated the command’s commitment to intensifying crime detection and prevention, adding that the fight against counterfeit drugs remains a priority.

Jimoh stated that investigations were ongoing, with more arrests expected as the command works to dismantle networks involved in distributing counterfeit medical products.

(NAN)

Leave a comment