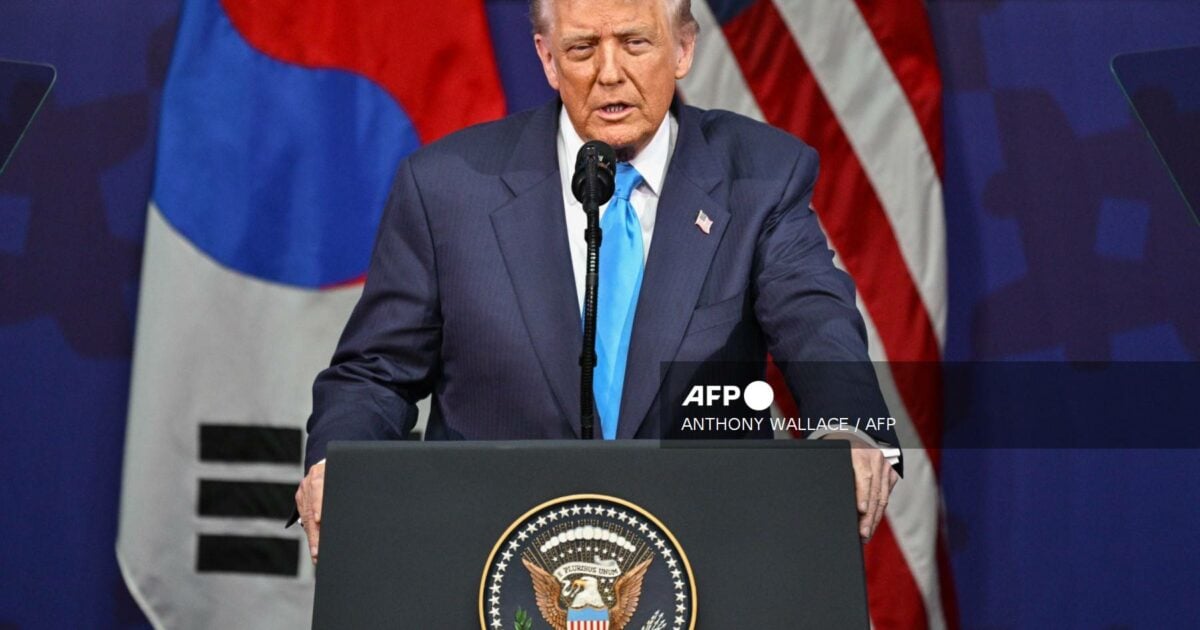

President Donald Trump on Tuesday announced expanded entry restrictions on foreign nationals from 24 countries, citing “demonstrated, persistent, and severe deficiencies in screening, vetting, and information-sharing” that threaten U.S. national security and public safety.

The announcement was published on the White House website in a fact sheet titled “President Donald J. Trump Further Restricts and Limits the Entry of Foreign Nationals to Protect the Security of the United States.”

According to the fact sheet, the Proclamation imposes full suspension on eight countries and partial suspension on 16 others, affecting immigrants and nonimmigrants on B-1, B-2, B-1/B-2, F, M, and J visas.

The administration described the move as necessary to “prevent the entry of foreign nationals about whom the United States lacks sufficient information to assess the risks they pose” and to enforce U.S. immigration laws while advancing national security objectives.

JUSTIFICATION FOR FULL SUSPENSION

Burkina Faso

According to the Department of State, terrorist organizations continue to plan and conduct terrorist activities throughout Burkina Faso. According to the Fiscal Year 2024, Department of Homeland Security (DHS) Entry/Exit Overstay Report (“Overstay Report”), Burkina Faso had a B-1/B-2 visa overstay rate of 9.16 percent and a student (F), vocational (M), and exchange visitor (J) visa overstay rate of 22.95 percent. Additionally, Burkina Faso has historically refused to accept back its removable nationals.

Laos

According to the Overstay Report, Laos had a B-1/B-2 visa overstay rate of 28.34 percent and an F, M, and J visa overstay rate of 11.41 percent. According to the Fiscal Year 2023, Department of Homeland Security (DHS) Entry/Exit Overstay Report (“2023 Overstay Report”), Laos had a B-1/B-2 visa overstay rate of 34.77 percent and an F, M, and J visa overstay rate of 6.49 percent. Additionally, Laos has historically failed to accept back its removable nationals.

Mali

According to the Department of State, armed conflict between the Malian government and armed groups is common throughout the country. Terrorist organizations operate freely in certain areas of Mali.

Niger

According to the Department of State, terrorists and their supporters are active in planning kidnappings in Niger, and they may attack anywhere in the country. According to the Overstay Report, Niger had a B-1/B-2 visa overstay rate of 13.41 percent and an F, M, and J visa overstay rate of 16.46 percent.

Sierra Leone

According to the Overstay Report, Sierra Leone had a B-1/B-2 overstay rate of 16.48 percent and an F, M, and J visa overstay rate of 35.83 percent. According to the 2023 Overstay Report, Sierra Leone had a B-1/B-2 visa overstay rate of 15.43 percent and an F, M, and J visa overstay rate of 35.83 percent. Additionally, Sierra Leone has historically failed to accept back its removable nationals.

South Sudan

According to the Overstay Report, South Sudan had a B-1/B-2 visa overstay rate of 6.99 percent and an F, M, and J visa overstay rate of 26.09 percent. Additionally, South Sudan has historically failed to accept back its removable nationals.

Syria

Syria is emerging from a protracted period of civil unrest and internal strife. While the country is working to address its security challenges in close coordination with the United States, Syria still lacks an adequate central authority for issuing passports or civil documents and does not have appropriate screening and vetting measures. According to the Overstay Report, Syria had a B1/B2 visa overstay rate of 7.09 percent and a F, M, and J visa overstay rate of 9.34 percent.

Palestinian Authority Documents

Several U.S.-designated terrorist groups operate actively in the West Bank or Gaza Strip and have murdered American citizens. Also, the recent war in these areas likely resulted in compromised vetting and screening abilities. In light of these factors, and considering the weak or nonexistent control exercised over these areas by the PA, individuals attempting to travel on PA-issued or endorsed travel documents cannot currently be properly vetted and approved for entry into the United States.

(Immigrants and Nonimmigrants on B-1, B-2, B-1/B-2, F, M, and J Visas)

Angola

According to the Overstay Report, Angola had a B-1/B-2 visa overstay rate of 14.43 percent and an F, M, and J visa overstay rate of 21.92 percent.

Antigua and Barbuda

Antigua and Barbuda has historically had Citizenship by Investment (CBI) without residency.

Benin

According to the Overstay Report, Benin had a B-1/B-2 visa overstay rate of 12.34 percent and an F, M, and J visa overstay rate of 36.77 percent.

Cote d’Ivoire

According to the Overstay Report, Cote d’Ivoire had a B-1/B-2 visa overstay rate of 8.47 percent and an F, M, and J visa overstay rate of 19.09 percent.

Dominica

Dominica has historically had CBI without residency.

Gabon

According to the Overstay Report, Gabon had a B-1/B-2 visa overstay rate of 13.72 percent and an F, M, and J visa overstay rate of 17.77 percent.

The Gambia

According to the Overstay Report, The Gambia had a B-1/B-2 visa overstay rate of 12.70 percent and an F, M, and J visa overstay rate of 38.79 percent. Additionally, The Gambia has historically refused to accept back its removable nationals.

Malawi

According to the Overstay Report, Malawi had a B-1/B-2 visa overstay rate of 22.45 percent and an F, M, and J visa overstay rate of 31.99 percent.

Mauritania

According to the Overstay Report, Mauritania had a B-1/B-2 visa overstay rate of 9.49 percent. According to the Department of State, the Government of Mauritania has little presence in certain parts of the country, which creates substantial screening and vetting difficulties.

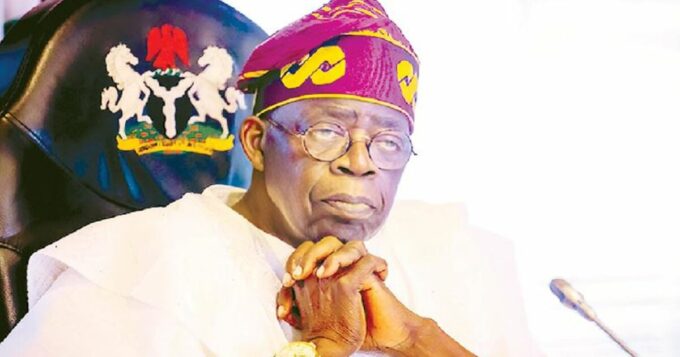

Nigeria

Radical Islamic terrorist groups such as Boko Haram and the Islamic State operate freely in certain parts of Nigeria, which creates substantial screening and vetting difficulties. According to the Overstay Report, Nigeria had a B-1/B-2 visa overstay rate of 5.56 percent and an F, M, and J visa overstay rate of 11.90 percent.

Senegal

According to the Overstay Report, Senegal had a B-1/B-2 visa overstay rate of 4.30 percent and an F, M, and J visa overstay rate of 13.07 percent.

Tanzania

According to the Overstay Report, Tanzania had a B-1/B-2 visa overstay rate of 8.30 percent and an F, M, and J visa overstay rate of 13.97 percent.

Tonga

According to the Overstay Report, Tonga had a B-1/B-2 visa overstay rate of 6.45 percent and an F, M, and J visa overstay rate of 14.44 percent.

Turkmenistan

Since the issuance of Proclamation 10949, Turkmenistan has engaged productively with the United States and demonstrated significant progress in improving its identity-management and information-sharing procedures.

The suspension of entry into the United States of nationals of Turkmenistan as nonimmigrants on B-1, B-2, B-1/B-2, F, M, and J visas is lifted. Because some concerns remain, the entry into the United States of nationals of Turkmenistan as immigrants remains suspended.

Zambia

According to the Overstay Report, Zambia had a B-1/B-2 visa overstay rate of 10.73 percent and an F, M, and J visa overstay rate of 21.02 percent.

Zimbabwe

According to the Overstay Report, Zimbabwe had a B-1/B-2 visa overstay rate of 7.89 percent and an F, M, and J visa overstay rate of 15.15 percent.

Africa: Burkina Faso, Mali, Niger, Sierra Leone, South Sudan, Angola, Benin, Cote d’Ivoire, Gabon, The Gambia, Malawi, Mauritania, Nigeria, Senegal, Tanzania, Zambia, Zimbabwe

Asia: Laos, Syria, Turkmenistan

Caribbean / Oceania: Antigua and Barbuda, Dominica, Tonga

Middle East / Palestinian Territories: Palestinian Authority-issued travel documents

The fact sheet emphasizes that these measures “are necessary to prevent the entry of foreign nationals about whom the United States lacks sufficient information to assess the risks they pose” and to enforce immigration laws while protecting American citizens.

Leave a comment