Digital payment channels now account for 43 per cent of fuel transactions in Nigeria, underscoring a rapid shift away from cash in the country’s downstream oil and gas sector, according to a new case study released by financial services platform Moniepoint.

The study, titled “Fuelling the Nation: How Moniepoint Powers Nigeria’s Oil and Gas Industry”, examined payment systems, access to credit and inventory management practices among petrol station operators nationwide. It found that point-of-sale terminals have become standard infrastructure in the sector, with 90.9 per cent of stations now relying on them for day-to-day operations.

Petrol stations play a critical role in Nigeria’s energy and transport ecosystem, particularly in areas with limited access to alternative energy sources.

Over 90 per cent of passenger and freight movement in the country is by road, with stations collectively facilitating an estimated 41 to 47 million litres of petrol daily, the report stated.

Despite this central role, operators continue to face structural financial challenges. One long-standing issue is the “T+1” settlement cycle, under which funds from card payments become available only the following day. In a sector characterised by thin margins and the need for rapid restocking, the delay often results in fuel shortages at stations, commonly referred to as “dead tanks”, and lost revenue.

The fintech unicorn said its same-day settlement solution is helping to address the liquidity gap by enabling station owners to access funds immediately, pay suppliers promptly and maintain consistent fuel availability. According to the findings, one in three station owners identified access to credit as their biggest recurring challenge.

The study also noted that Moniepoint has disbursed millions of naira in working capital to fuel retailers, recording a 99.81 per cent repayment success rate. These interventions have helped nearly three in five petrol stations transition from cash-dependent, manually operated businesses to digitally enabled enterprises with access to payments infrastructure and growth capital.

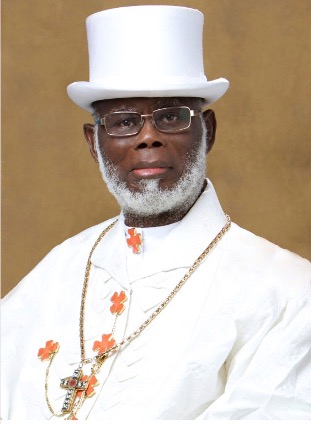

Commenting on the report, Managing Director of Moniepoint Microfinance Bank, Babatunde Olofin, said the study was aimed at deepening policy engagement and providing data-driven insights to support Nigeria’s socio-economic development.

“We are pleased to release this comprehensive report on Nigeria’s downstream sector,” Olofin said. “With data from business transactions and our management tools, petrol stations can plan inventory more effectively, know when to restock and ensure operations run smoothly to serve more customers.”

He added that improving access to financial tools for fuel retailers would strengthen fuel distribution and support a more efficient and equitable energy system.

The downstream oil and gas case study follows earlier Moniepoint reports on sectors including family-owned businesses, open markets, community pharmacies, women-led enterprises and agriculture in the North-East. Together, the reports examine how digital payments and financial services are reshaping Nigeria’s informal and formal economies.

Moniepoint processes billions of naira in transactions monthly and provides payments, banking, credit and business management solutions to millions of businesses across Nigeria, positioning the company as a key player in the country’s drive toward greater financial inclusion and operational efficiency.

Leave a comment