Walks with the Artist

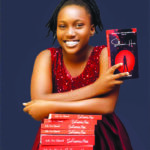

UK-based Jessica Ajuyah’s Lagos solo exhibition sidesteps the city’s hubbub, urging visitors to linger and discover how memory sneaks between the colours. Okechukwu Uwaezuoke writes

Terra Kulture, arguably Lagos’s most renowned cultural hub, nestled in the upmarket Victoria Island neighbourhood, slips into a different ambience today at 4pm (February 15). Should its habitués expect glitzy spectacle—camera flashes and networking disguised as delight—they are likely to find little or none of it. The evening event, an exhibition titled The Shape of Memory, offers something quieter and more demanding: introspection.

Though rarely calm, even on a Sunday, Lagos tempers its weekday crescendo of horn, heat, and heroic impatience. Somewhere, a church service spills past its allotted hour. A tone-deaf DJ revels in unleashing a percussive assault on an otherwise serene neighbourhood. Against that restless city, Jessica Ajuyah’s exhibition feels almost countercultural. It does not compete. It lingers, quietly claiming its space.

On until February 21, the show holds court in the gallery like a quietly resonant chord, resisting the contemporary appetite for instant intelligibility. Meaning emerges gradually—through colour, posture, and recurrence.

Ajuyah, a UK-based artist and art director working between Sheffield and Nigeria, treats memory not as nostalgia but as structure. The project began with a question: how do lived and inherited experiences embed themselves within identity? Her answer unfolds across 14 paintings, mapping remembrance as something layered, formative, and quietly insistent.

The works, she notes, were conceived as companions. From the very beginning, they were conscious of one another: surfaces echo, temper, and converse across the room. Yet each canvas asserts its own presence. Some arrived fully formed, their existence undeniable; others resisted, demanding return, reflection, and restraint. She speaks of revisiting a painting, adjusting a tone, paring away the superfluous until only what is essential remains. That quiet discipline knits the exhibition together. Its coherence arises not from uniformity but from shared attentiveness to nuance.

The gallery feels less like a sequence than a constellation. The paintings do not advance linearly; they drift through emotional states—withdrawal, openness, assertion, pause. Warm pigments find their counterpoint in cooler restraint. Gestures recur, subtly altered. There is rhythm without choreography.

At its centre are women—not as symbols, but as presences. Youth surfaces in one posture; endurance settles into another. Growth and doubt are suggested rather than explained. Ajuyah trusts silence. Meaning deepens through looking and through returning. A motif glimpsed early reappears, altered and deepened, inviting recognition rather than declaration.

The Lagos setting sharpens the work’s resonance. Ajuyah’s childhood and adolescence in Nigeria underpin much of the series. These memories, reconsidered from abroad, carry both intimacy and distance. Returning them to Lagos does not resolve that tension; it intensifies it. The city hums just beyond the frame—its rhythms, textures, and restless cadence seeping in. Recognition becomes layered, provisional, and never immediate.

The exhibition reflects on return—not as sentimental homecoming but as an encounter between past and present selves. The paintings hold that friction, allowing it to breathe. In a city defined by immediacy, they insist on interiority. There is a quiet suggestion here: what forms inwardly will, in time, find its outer shape.

Ajuyah’s attentiveness extends beyond the canvases to the installation itself. Framing, spacing, and light are deliberate. Each work is granted room to assert itself. The intervals between them function as pauses, letting the eye reset and the mind register nuance. Subtle contrasts are staged: introspection beside assertion, bloom beside restraint. The gallery becomes a score, each painting a note, each pause as eloquent as the brushwork.

Sound threads through the space with understated insistence. A playlist dominated by female artists shapes the atmosphere without narrating the work. Music does not explain; it steadies, guides, and suspends. Lyrics are chosen for tonal affinity rather than literal message, while instrumentals open intervals of reflection. The result is cohesion without prescription, a rhythm that complements rather than competes.

Colour operates as the exhibition’s primary language. Warm tones—pinks, reds, burnished orange—speak of intimacy, comfort, and belonging. Cooler blues and greens recede into contemplation. At previous showings, viewers spoke of these hues stirring personal recollections: a room once inhabited, a garment once worn, a season remembered. The paintings do not dictate memory; they activate it.

Recurring motifs anchor the series. Flowers signal growth, transition, and fragility; domestic details tether abstraction to the familiar. Some compositions open outward, expansive; others turn inward, concentrated. Together they mirror memory’s oscillation—sharp in places, blurred in others; always layered.

Two works crystallise the exhibition’s emotional spectrum. “Raspberry” vibrates with vivid confidence, its bright pinks reflecting the courage of self-acceptance and the messiness of becoming. In counterpoint, “Muted Bloom” retreats into muted tones, its figure shaped by external expectation, softened by the pressure of others’ voices. Assertion stands beside constraint; bloom beside reticence.

Exhibition texts are judicious in their density. Some contextualise; others deliberately withhold. This restraint is strategic: immediate explanation can foreclose the intimate, meandering associations viewers bring. In earlier showings, audiences shared family histories, private reckonings, recollections triggered by a gesture or shade. The Lagos iteration preserves this openness, allowing the paintings to remain porous and suggestive.

The exhibition’s visual identity reinforces its focus on Black women—not as subjects seeking validation but as presences that command it. Typography is disciplined; black is used decisively. Scale and materiality are handled with precision, ensuring nothing detracts from the work’s quiet authority.

Movement through the gallery is deliberately non-linear. There is no prescribed beginning or end. Visitors circle back, linger, or drift ahead. The arrangement mirrors memory itself: recursive, selective, occasionally surprising. Some impressions insist; others reveal themselves only in time.

What lingers after leaving Terra Kulture is not a conclusion but a recalibration of attention. The exhibition refines perception, suggesting that memory is not a passive archive but a living force—shaping, pressing, seeking expression. In a city defined by velocity, The Shape of Memory quietly argues for stillness, for the slow, inevitable unfolding of inner life, and for the subtle power of remembering well.

Leave a comment