Yinka Olatunbosun

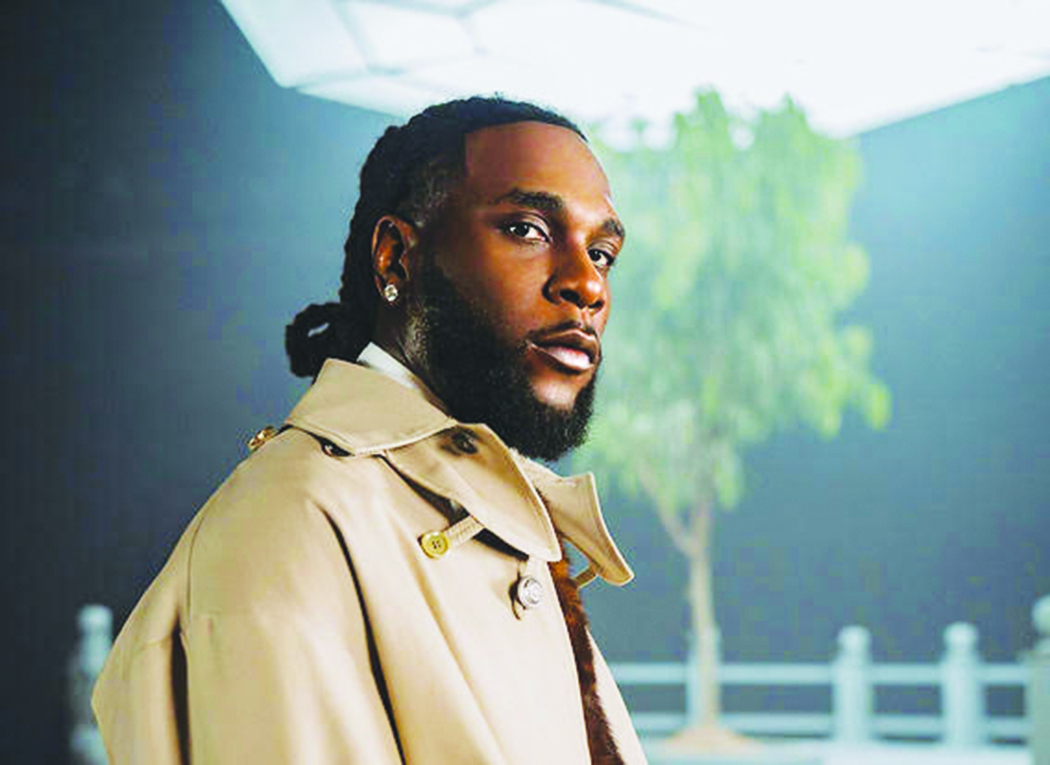

On the heels of its record-breaking and fastest ever sell-out of its 2026 edition on Saturday 1st and Sunday August 2nd 2026, Reggae Land is matching demand by expanding into a three day festival for the first time, with July 31st which is a Friday to be headlined by global superstar Burna Boy, who plays the festival for the first time.

Revered as one of the most influential artists of his generation, Burna Boy’s appearance represents another landmark moment for Reggae Land. The newly added Friday transforms the festival into a three-day celebration for the first time in its history. It takes place at Milton Keynes National Bowl ahead of the sold-out weekend complete with the high production values Reggae Land is known for.

The award winning Nigerian singer and songwriter blends Afro fusion, dancehall and hip-hop into catchy, indelible hits that have soundtracked summers for the last decade. Expect to hear favourites like ‘Last Last, Ye’ and ‘City Boys,’ with magnetic charm and smooth flowing rhythms opening the weekend with a statement show and setting the tone for what is already shaping up to be the festival’s biggest year yet.

The announcement follows extraordinary demand for Reggae Land 2026, which sold out in record time after tickets went on sale last week. With over 120 artists already confirmed across seven stages, Reggae Land’s rapid rise continues to position it as one of the UK’s fastest-growing and most culturally significant festivals.

From roots reggae and dancehall to dub, jungle and carnival energy, Reggae Land has become a defining platform for Caribbean music and culture in the UK. The addition of Friday underscores the festival’s evolution, driven directly by fan demand and community momentum.

Leave a comment