The Federal Inland Revenue Service (FIRS) has instructed all banks in Nigeria to immediately identify and close any tax and levy collection accounts that are not authorised under the agency’s TaxPro Max system.

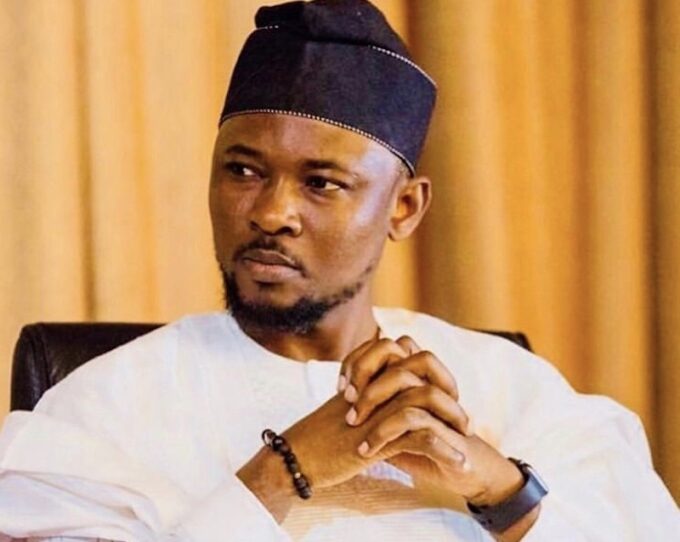

This directive, announced through a public notice issued by the Executive Chairman of FIRS, Zacch Adedeji, and shared with journalists on Monday by his Special Adviser on Media, Dare Adekanmbi, is part of the agency’s ongoing reforms aimed at improving transparency, accountability, and efficiency in Nigeria’s tax collection framework.

The notice states that all tax and levy collections must now be processed exclusively through the TaxPro Max platform, a digital solution introduced by FIRS to centralise and automate tax administration processes. Titled “Directive to Close Unauthorised FIRS Tax Collection Accounts,” the notice underscores that any accounts outside the TaxPro Max system are deemed unauthorised. Banks are therefore required to cease the use of such accounts immediately and adhere to the new collection procedure.

“Effective immediately, all tax and levy collections on behalf of FIRS must be processed exclusively pursuant to an assessment raised on the TaxPro Max platform. All banks participating in the FIRS Collection, Remittance, and Reconciliation Scheme are hereby advised to comply with this directive within the stipulated period,” the notice read. “We count on your cooperation to ensure a smooth transition to this centralised system, thereby contributing to a more transparent and efficient tax collection process.”

FIRS further reiterated that banks involved in its Collection, Remittance, and Reconciliation Scheme must process only transactions originating from TaxPro Max-generated assessments. The agency highlighted that this shift would also improve real-time reconciliation of collections, reduce revenue leakages, and bolster its broader digitalisation efforts.

In light of this directive, banks are expected to align their internal tax collection mechanisms with the TaxPro Max system to avoid potential regulatory breaches. Non-compliance with the directive could result in sanctions or exclusion from future FIRS tax collection activities.

For taxpayers, the transition means that all payments to FIRS must now be based solely on assessments raised via the TaxPro Max portal. Payments made through unauthorised channels or to unauthorised accounts will be invalid and may expose taxpayers to penalties.

To facilitate the transition, FIRS has encouraged both taxpayers and banks to contact its Revenue Accounting and Refund Department (RAAD) for any clarifications or assistance.

This directive represents a significant step towards tightening Nigeria’s tax collection processes, reducing revenue leakages from unauthorised accounts, and reinforcing FIRS’s commitment to using technology to drive greater transparency and accountability in the tax ecosystem.

Leave a comment