“Edgar, I used to think you were a reasonable fellow; guess I read you wrongly.”

That was a top executive in the capital market in response to my very telling article on the liquidity crises in the Nigerian capital market. Let me explain to those of you who don’t know.

So, our stock exchange has crossed the N100 trillion valuation mark and gave one of the best global returns of 51% last year. Brilliant abi? Well, all of that is just what we call valuation with no liquidity. Basically, there are no shares to be bought as five major “men” control over 60% of the shares, and they will not hold.

There is something they call free float. Free float is the number of shares that should be made available to trade. In better countries, free float hovers between 30 and 40%. In our Naija, it is 3.6%.

Let me explain it in Shomolu terms so you all better understand: One big man opens a company and sells cement, food and others. He lists the company on the exchange but holds 88% of the shares for himself. He gives another 12% to a nominee to hold indirectly for him, leaving less than 5% for the rest of us. So basically, we have private firms masquerading as public firms, and this throws up the liquidity crises, as there are no real shares to buy or sell.

Our pension money, which is about N3 trillion, is trapped in there, and the market cannot take $50m as we speak.

That is the essay I wrote o Nigerians, that this guy, who I can even beat – if it’s a fight – and who I senior in age, send me a quote that I am unreasonable.

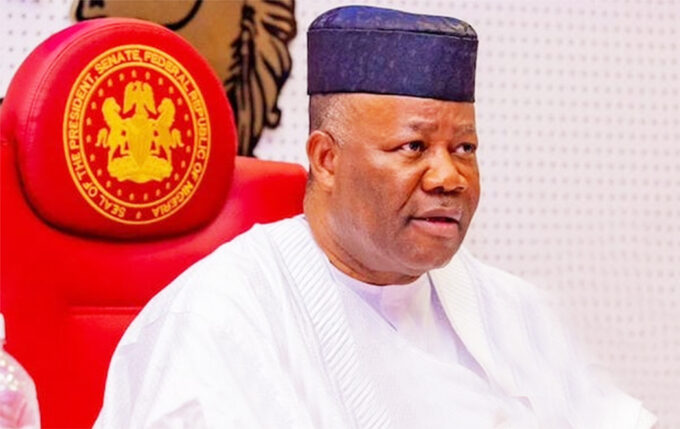

Thankfully, the DG of SEC, Dr Agama, is a very brilliant and hardworking man. He quickly called me and discussed at length how he has been fighting the matter.

“Edgar, I issued a query the other day to one of those firms, and he was released, but the market could not absorb. Edgar, we are calling a liquidity crisis session amongst all stakeholders to look into this matter and come up with sustainable solutions.”

Now, that is how super administrators talk, not like that “boy” that they gave MD, and he is coming to abuse me.

Not only him o, but even members of the Chartered Institute of Stockbrokers who are hiding under a blanket and calling me “chronic debtor” because I refused to pay their membership dues as I no see what benefit of their membership is doing to me.

Nigerians, when there is an issue, let’s face the issue and stop attacking the towncrier. My not paying membership dues of a funny association will not solve an issue that has seen over 40% of stockbroking firms go under in recent times.

My confidence in Dr. Agama in resolving this problem is very strong, and I wish him well.

Thank you.

Leave a comment