By Tosin Clegg

In the fast-changing world of African tech, scaling is no longer about surviving the local market—it’s about owning a place in the global value chain.

Startups from Africa’s major innovation hubs are chasing growth in the U.S., Europe, and Asia. But while venture headlines often spotlight funding wins, the hard truth is that the deals that fuel global expansion are won or lost long before term sheets are signed.

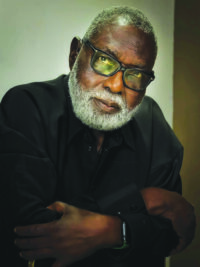

A dual-qualified lawyer and consultant in England & Wales and Nigeria, Badmus has quietly become one of the go-to advisors for African founders navigating complex cross-border deals, high-stakes mergers, and investor-driven restructurings. His legal fingerprints spanning fintech, private equity, capital markets, logistics, and AI infrastructure.

“You can’t approach a $10 million U.S. venture deal with the same mindset you used to close your seed round in Lagos,” Badmus says. “The language, expectations, and legal mechanics are different—and they’re not forgiving to those who guess.”

Badmus has worked on everything from restructuring African holdcos into Delaware and UK entities to advising on share purchase agreements that bring Silicon Valley capital into African businesses.

In one recent mandate, he guided a pan-African logistics company through a reverse triangular merger, ensuring not only regulatory clearance across jurisdictions but also investor-friendly governance terms that unlocked a seven-figure funding tranche.

“It’s not just paperwork,” he says. “It’s about setting the foundation so that when opportunity knocks—whether it’s a U.S. VC, a London private equity house, or a global corporate buyer—you’re ready to answer.”

Badmus also navigates areas founders often overlook until it’s too late: U.S. and EU data protection regimes, intellectual property defense across multiple territories, and liability frameworks for emerging tech.

With AI, blockchain, and cross-border payments drawing increased regulatory scrutiny, he believes the winners will be those who treat compliance as an asset, not a burden.

His influence extends beyond the boardroom. Recognized for thought leadership in African legal and technology circles, he has published widely on risk management in mergers and acquisitions, and his advisory style has earned praise from both startup founders and institutional investors.

“I believe African founders are not just building local solutions—they’re building globally relevant companies,” Badmus says. “My job is to make sure the legal side is an enabler, not a bottleneck.” For startups aiming to trade local momentum for global dominance, that’s more than just good advice—it’s a survival strategy.

Leave a comment