Importance Of Financial Management: How to Make the Most of Your Money [in 2022]

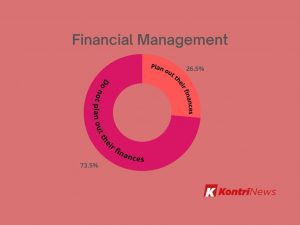

There is a number of reasons people struggle with their finances, One reason is that many people do not understand basic financial concepts.

For example, many people do not understand the difference between assets and liabilities, or between gross and net income. In addition, they do not have a budget, which makes it difficult to track their spending and make informed financial decisions.

To say the least, a lot of people are not good at delaying gratification, which can lead to overspending and debt problems.

In this blog post, we will discuss tips on how you can make the most of your money.

that’s where the importance of financial management comes to play.

What Is Financial management?

Financial management is a field that deals with the allocation and utilization of financial resources in order to achieve desired economic outcomes.

It covers a wide range of topics, including investment analysis, portfolio management, capital budgeting, risk management, and insurance.

Financial managers work in a variety of industries, including banking, insurance, accounting, and investment.

The goal of financial management is to create value for shareholders by maximizing the return on their investment while minimizing risk.

Financial managers use a variety of tools to make decisions about how to allocate resources. These tools include financial statements, discounted cash flow analysis, and risk-return analysis.

Financial managers also use their knowledge of financial markets to make decisions about where to invest company funds.

Why Is Financial Management important?

- There are a few key reasons why financial management is so important.

- If you’re not able to keep track of your finances, it can quickly lead to bankruptcy.

- Good financial management allows individuals or companies to make informed decisions about where to allocate their resources.

- strong financial management can help a company attract investors and maintain a healthy stock price.

How To Apply Financial management

When it comes to handling your money, here are a few key things you can do to stay on top of your finances.

a. Understand your income

There are a few key things to keep in mind when it comes to understanding your income and how it can help manage your finances. First, your income is what gives you the money to live on and pay your bills. It’s important to know how much money you have coming in so that you can budget accordingly. Second, your income can fluctuate from month to month, so it’s important to be aware of this and plan for it. Lastly, your income can be a source of financial stress if you’re not careful with it.

b. create a budget

One of the most important things you can do to manage your finances is to create a budget. A budget will help you track your spending, see where your money is going, and make conscious decisions about how to best use your money.

Creating a budget may seem daunting, but it doesn’t have to be complicated. Start by tracking your income and expenses for a month. Once you have a good understanding of your spending patterns, you can begin to make adjustments to ensure that your spending aligns with your financial goals.

If you are not sure where to start, there are many resources available to help you create a budget that works for you. The most important thing is to get started and to be consistent with your budgeting. The more you practice, the easier it will become. And soon, you’ll be on your way to better managing your finances.

c. live below your means

Living below your means can help you manage your finances in a number of ways. Perhaps most importantly, it can help you save money. When you live below your means, you are spending less than you earn, which means you have extra money to put into savings. This can help you reach your financial goals quicker and make it easier to weather unexpected expenses.

Additionally, living below your means can help you reduce your overall debt. If you are only spending what you can afford, you are less likely to rack up credit card debt or other loans that can be difficult to repay. This can help you keep more of your hard-earned money and improve your financial stability.

d. Have an emergency fund

If you’re like most people, you probably don’t have much money saved up in case of an emergency. This can be a big problem if something unexpected comes up, like a medical bill or a car repair.

That’s where an emergency fund comes in. Having some money set aside specifically for emergencies can help you cover unexpected costs without having to put them on a credit card or take out a loan.

There are a few different ways to save for an emergency fund. You can open a savings account specifically for this purpose, or you can set aside some money each month in your regular checking or savings account.

Whatever method you choose, the important thing is to start saving now so you’ll be prepared if an emergency does come up.

e. Find ways to save money

Saving money can help you manage your finances better in several ways. First, it can give you a cushion to cover unexpected expenses. This can prevent you from going into debt or having to rely on credit cards to make ends meet. Second, saving money can help you build up an emergency fund. This can give you peace of mind knowing that you have money set aside to cover unexpected costs, such as a car repair or medical bill. Third, saving money can help you reach your financial goals. By setting aside money each month, you can make progress towards buying a home, investing for retirement, or taking a dream vacation. fourth, saving money can give you more flexibility in your budget.

f. Invest money wisely

Investing money wisely can help you manage your finances in several ways. First, it can help you save money. By investing wisely, you can put your money into investments that will grow over time, such as stocks or mutual funds. This can help you build up your savings so that you have more to spend in the future. Second, investing can help you make money. If you invest in something that increases in value over time, such as a stock or real estate, you can make a profit from it when you sell it. Finally, investing can help you protect your money. By investing in things like insurance or bonds, you can safeguard your money against unexpected events, such as losing your job or suffering a medical emergency.

g. keep an eye on your credit score

Your credit score is a number that indicates your creditworthiness. It is used by lenders to determine whether you are a good candidate for a loan. A high credit score means you are a low-risk borrower, and a low credit score means you are a high-risk borrower.

Keeping an eye on your credit score can help you manage your finances. If you see your score going down, it may be time to check your credit report for errors. You can also take steps to improve your credit score, such as paying your bills on time and keeping your debt levels low.

Monitoring your credit score can help you stay on top of your financial health. It’s a good idea to check your score regularly, so you can catch any potential problems early.

Conclusion

Congratulations on making it to the end of this guide.

I hope you feel more equipped to take control of your finances and start building a brighter future for yourself.

Remember, understanding your income, creating a budget, keeping track of expenses, and living below your means are all key steps in becoming financially secure.

Additionally, having an emergency fund will help prevent you from falling into debt if something unexpected happens.

Finally, be sure to invest money wisely and keep an eye on your credit score so you can maintain good financial health now and in the future. How have you started improving your finances? What challenges do you still face? Let us know in the comments below.